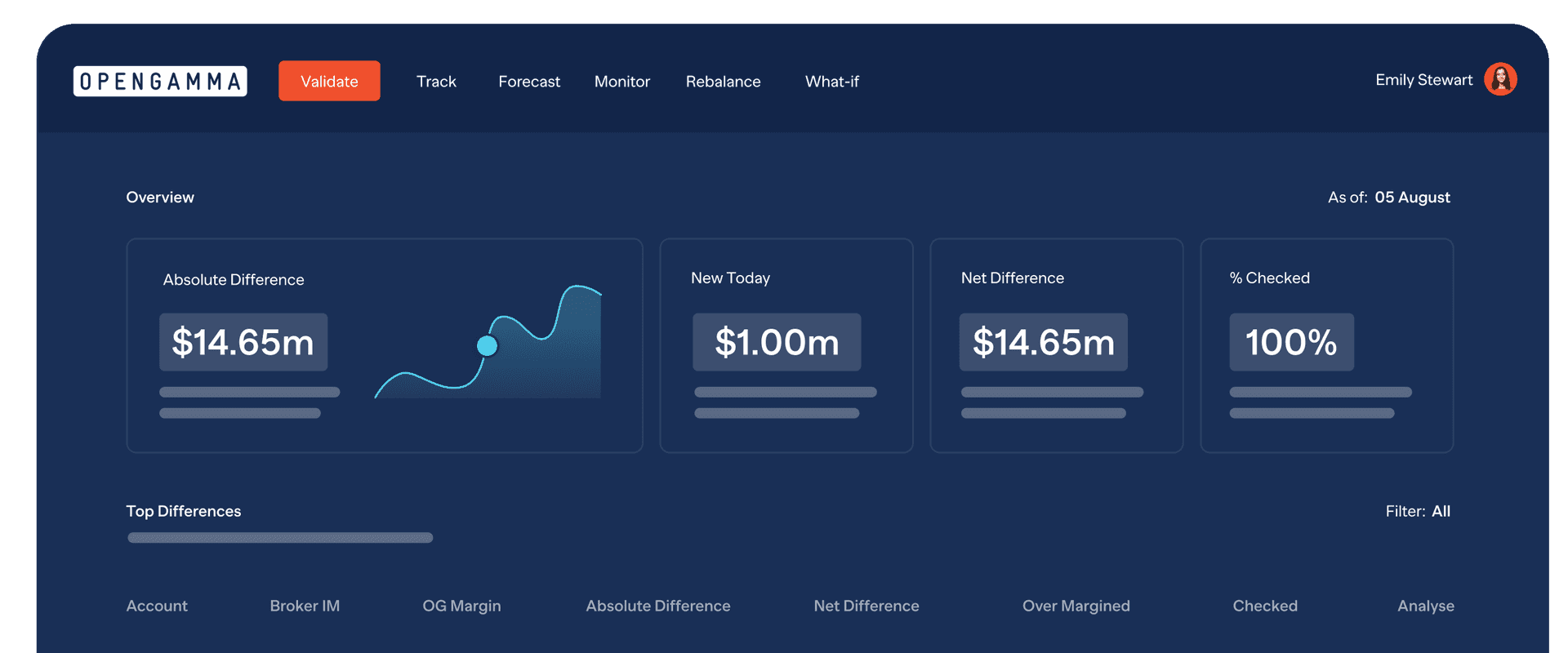

Adapt to new regulation with smart workflows, and say goodbye to outdated legacy systems.

Reduce risk to protect investor assets.

Increase efficiency to lower costs and identify opportunities to increase returns.

Increase Returns

Unlock the potential of your assets.

Increase Returns

Unlock the potential of your assets.

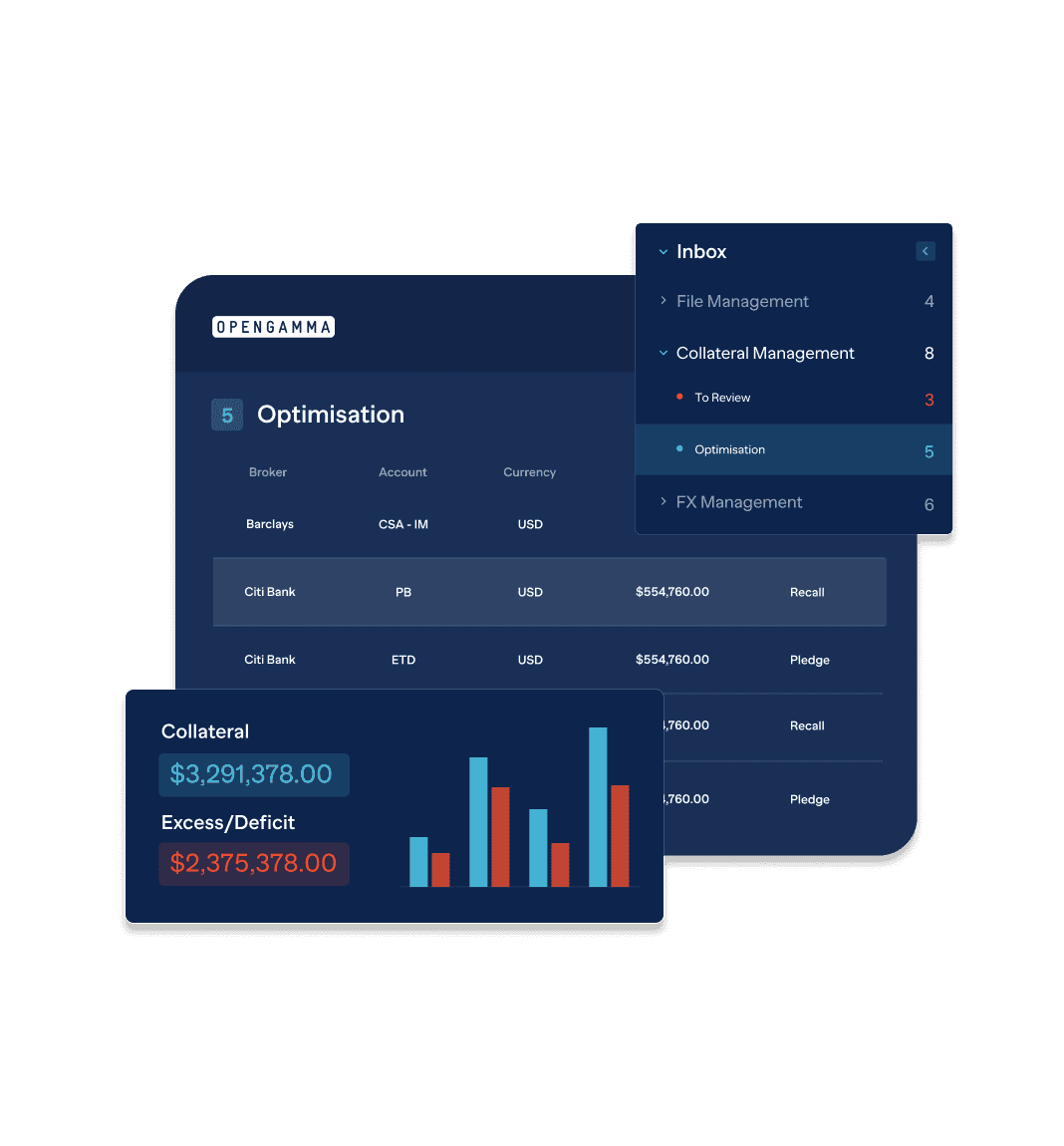

New regulation and market volatility has caused margin requirements to spike, resulting in more collateral being tied up. It’s now more important than ever to optimize these assets.

What our customers say

"We're constantly on the lookout for the right technology to drive efficiencies. OpenGamma’s platform forms an important part of our overall approach to delivering operational efficiencies for derivatives for our clients."

Josh Ratner

Head of Operations

Reduce risk

Protect investor assets.

Reduce

Reduce over-collateralization.

Automate

Meet regulation while lowering cost.

Automate

Meet regulation while lowering cost.

Our platform aggregates, processes, and understands broad data sets, providing a single source of truth.

Keep learning

Insights from our experts.

EBOOK

Gas and Power: Sudden Changes in Margin

For Commodity Trading Firms, spikes in margin requirements can be difficult to predict. Find out all you need to know in our complete guide.

Learn More

INSIGHT

How can margin multipliers be used to challenge margin calls

Learn more