Find Out How To Reduce Margin Requirements Through Margin Optimisation

Optimisation is a term that is often used in conjunction with margin and collateral but what exactly does it mean?

The obvious answer is ‘reduce margin’ but there are many different considerations when looking to reduce margin to the lowest level possible — and the lowest possible level can be considerably lower than the highest.

Simply by making careful choices of where you place your business — be it the choice of whether to clear or not or ensuring that offsetting ETD and OTC trades are cleared at the same CCP — savings of over 50% on margin costs are perfectly possible to achieve.

So, what do you need to consider in order to minimise margin costs and maximise your returns?

OTC Margin

With UMR Phase 4 fast approaching and Phase 5 just over a year away, perhaps the most relevant method of optimisation is whether to clear or not. For some products, because of the various clearing mandates, there won’t be a choice. But you still might be able to find a way of optimising delta or FX risk between cleared and uncleared business.

For uncleared, margin is likely to be calculated under SIMM. As a margin algorithm, SIMM tends to calculate higher numbers than the CCP algorithms. This is mainly because it is based on a 10 day rather than 5 day holding period, but other features such as the symmetrical nature of the calculation and the use of, for example, the same interest rate correlations between tenors for all currencies, can make it significantly different for some trades.

Unfortunately, it’s not as simple as deciding to clear the business. You then need to decide where to clear it.

A product may be eligible to clear at a number of different CCPs, but you also need to consider the liquidity at a given CCP and also whether there is any pricing basis between the CCPs.

You may also have an existing position at a CCP which could offset any new trades.

All of these being equal, you then need to consider the level of margin that will be required and there can be considerable difference in the margin calculated.

So optimisation in this case would be looking for the cheapest clearing house.

We took a portfolio consisting of EUR swaps of varying maturities. When margin was calculated for this portfolio the results for CCP 1 and CCP 2 were as follows:

CCP 1 – €846,996,333

CCP2 – €532,554,266

The CCP1 margin is over 60% greater than the CCP2 margin for the same portfolio — it should be noted though that for a different portfolio it is equally possible that the CCP1 margin would be lower than the CCP2 margin.

ETD Margin

The same choice of CCP is also available for some Exchange Traded Derivatives (ETD).

There is generally a primary exchange for any particular product — for example, Eurex for Bund futures — but it’s not necessarily the only option; you can also trade Bund Futures at ICE, however, you may find that the liquidity is not available to justify any difference in margin.

When you look at the margin charged there can be a considerable difference. If both CCPs are using SPAN, differences in the scanning range set by each CCP of up to 40% are not unusual. If the CCP has moved to using VaR as a margin methodology, then there can be huge benefits to be gained from the greater portfolio effect, but these have to be considered alongside the asymmetric nature of VaR which can lead to considerable differences in the margin calculated between long and short positions.

As a simple example, let’s consider STIR futures.

Equivalent Eurodollar and Euribor Futures are available at multiple exchanges, each of which uses a different approach to margining, although they are all aiming to cover the same risk.

For Eurodollar Futures, SPAN is the margin algorithm used. For one CCP the same scanning range is used across all expiries of $506.25, based on a 2-day holding period. However, on another the scanning range varies between $190 for short dated expiries and $435 for longer dated expiries, based on a 1-day holding period. Even if we take into account a potential EMIR add-on — to make the margin equivalent to a 2-day rather than a 1-day holding period — then the margin is still nearly 50% lower at the second CCP for front months, but 20% higher for back months.

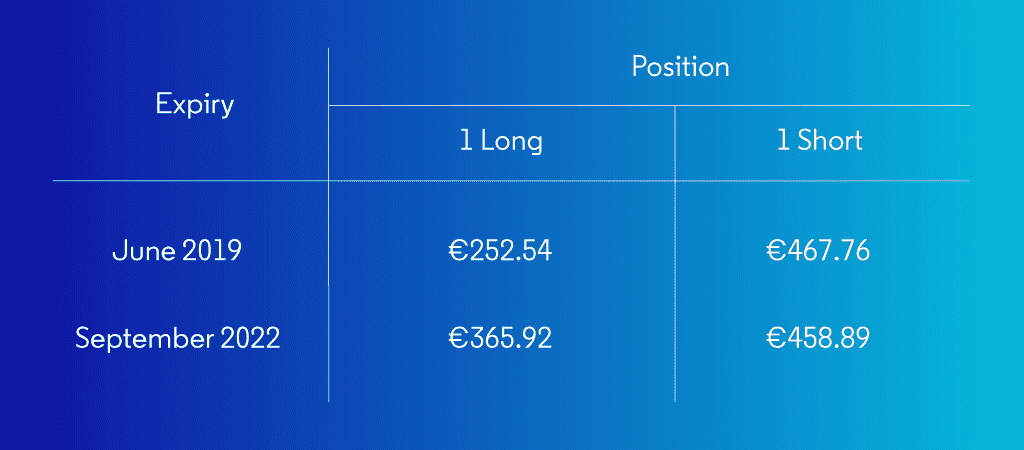

For Euribor, the choice is between SPAN and VaR based margining. On the SPAN CCP, the scanning range for all expiries is €347.50. For VaR based margin we can look at the equivalent margin for a 1 lot position. This varies dependent on expiry and whether you are long or short as shown in the following table:

As can be seen, where margin is cheapest depends on both the expiry and the direction, but the difference between the 2 CCPs can be up to 30%.

Cross Margin

Then, of course, there are the potential offsets between OTC and ETD portfolios. When you move ETD positions from margining under the ETD methodology to cross margining under the OTC methodology, you are moving from a 2 day to a 5 day holding period.

This will mean a higher margin on the ETD positions but – because of the offsets with the OTC portfolio – you will get a lower total margin calculated.

Of course, this is only true if there are offsets, so some kind of optimisation algorithm is required to determine the amount of ETD to move into the OTC calculation. Some CCPs include this optimisation within the methodology, for example, Eurex Prisma, whereas others provide optimisation tools to help users decide which ETD positions to move.

However, the ETD versus OTC question is made harder by the fact that the obvious choice of CCP is not usually the same for the ETD and OTC parts of the portfolio. For example, most Euro swaps are cleared through LCH, but Euribor futures are generally traded at ICE and Bund futures at Eurex. There are decisions to be made as to whether it is worth moving one or other away from the major CCP in order to benefit from the margin reduction. But if you do have the correct OTC versus ETD portfolio, margin savings of even 80% could be possible — although it would have to be very well hedged.

Choice of Broker

Where you place your business can also change the amount of margin you pay. You need to carefully consider how you allocate trades to different brokers to ensure that you make best use of all the available margin reductions, for example by ensuring offsetting positions are placed with the same broker to benefit from savings within the margin algorithm, or by splitting large positions between multiple brokers to minimise liquidity add-ons.

If you are clearing, all margin algorithms include a liquidity charge. This charge is higher the larger your position, so if you split your portfolio between different brokers then you can minimise this charge. Our analysis has shown that margin savings of around 25% can be achieved.

Collateral

If you are a clearing member then you will need to place collateral with the CCP to cover your margin. Unfortunately, just working out which CCP will charge the lowest margin isn’t the end of the optimisation question. The acceptable collateral and the haircuts applied also need to be considered.

Each CCP will have a list of collateral that is eligible to cover margin liabilities. All CCPs allow cash and government bonds, some also allow other assets to be used as collateral, for example, equities or metal warrants. So the choice of CCP might be based on whether the collateral you have available is accepted.

When determining the amount of collateral required to cover margin liabilities, CCPs will apply a haircut to the collateral value:

- Full value will be given to cash

- Haircuts for non-cash collateral will be dependent on the volatility of the collateral value

- FX haircuts will be applied for both cash and non-cash collateral where collateral in one currency has been used to cover a liability in another currency.

As a result, in order to completely optimise the margin paid you need to consider the collateral required as well because, of course, the haircuts applied vary across CCPs and depending on the currency that margin is calculated in, you may also find yourself paying an FX haircut. If you get this one right, a saving of around 20% in the value of the collateral required to cover the risk on the same portfolio could be possible.

If you want to optimise your margin and increase your return on capital then there are a number of things you need to consider; bilateral vs. cleared, choice of CCP, cross margining of OTC versus ETD, and choice of broker but if you make the correct choices, you could reduce your margin costs by up to 50%.

Obviously to do this you need to have a solution that replicates the different algorithms and calculates the margin savings but with the amount that can be saved this could be a worthwhile investment.

Find out more about the OpenGamma platform.