The Bank of England system-wide exploratory scenario (SWES) exercise has highlighted the need for using stress testing to determine liquidity requirements.

Participants are now in the stress scenario phase of the SWES, where a range of banks, insurers and fund managers are modelling the impact of a given set of shocks as well as being asked to detail any actions they would take in response. There will then be a second round of stress testing, taking into account any amplification effects that might result from the intended actions from the first, for example closing positions or selling assets to fund margin.

This second round will start soon, with final results expected by the end of the year. The stress scenarios that have been provided are hypothetical, but are driven by the worst moves seen during the March 2020 “dash for cash” and the September 2022 “LDI episode” triggered by the UK mini budget.

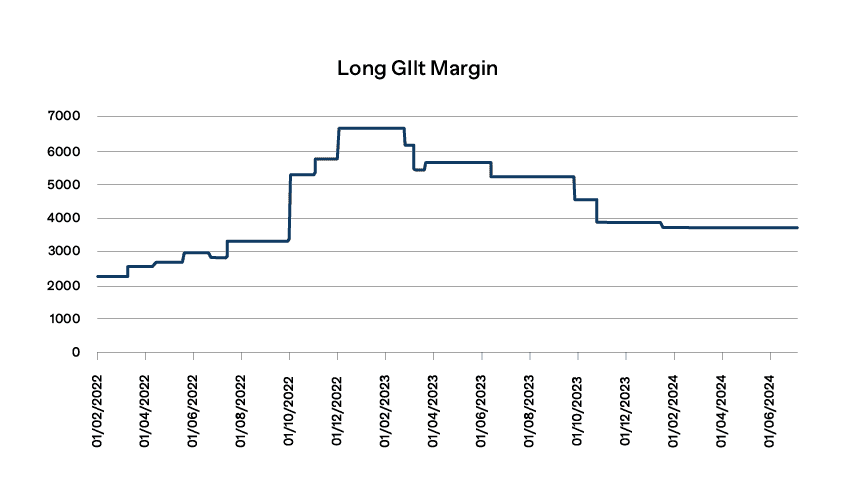

So what are the results likely to look like and how bad could the liquidity requirements be? By just concentrating on the LDI episode and the impact it had on Initial Margin for Long Gilt futures on ICE it is easy to see just how big the impact on liquidity could be.

Long Gilt Margin

The following chart shows how Long Gilt Initial Margin has changed since the beginning of 2022.

Historically there has been little change in Long Gilt margin levels, although the beginning of 2022 did see a series of increases from £2,240 to £3,280, a rise of nearly 50%.

However, it was the increase following the mini budget that was most significant. Initial Margin requirements more than doubled to £6,650 over the next two months. This was at the same time as market participants were having to fund Variation Margin based on the change in yields and finding themselves having to sell Gilts to fund this, contributing further to the volatility.

Once the dust had settled, the fall back to more normal Initial Margin levels was much slower, and they are still higher than before the crisis. It took over a year to drop back to £3,680, a level it has stayed at since the beginning of 2024.

These figures show how price moves and volatility can impact the level of Initial Margin. The increases in both in September 2022 caused the InItial Margin to spike. These price moves then became part of the analysis going forward, meaning requirements needed to stay high on the assumption that the same could happen again. But the inclusion of volatility in this same analysis meant that as this dropped off the Initial Margin began to reduce.

Initial Margin and Stress Testing

This looks at just one contract and how the Initial Margin is likely to be impacted by the SWES scenarios based on historical data shows the need to model Initial Margin as part of any stress testing. And unlike Variation Margin, which is a simple profit and loss calculation, the impact of a stress scenario on Initial Margin can be difficult to quantify.

In order to stress test Initial Margin you need to understand the methodology being used as well as the way this is parameterised. How price moves and volatility impact requirements varies by product and CCP and unlike Variation Margin, the impact can linger long after the event that caused the initial shock.