UMR Phases Are Driving Firms Toward Clearing, What Is The Impact?

The latter phases of UMR are causing more firms to look at the possibility of clearing, with the potential to change the balance between buy and sell side looking to use the services of various CCPs. This should lead to increased liquidity and a shift in the CCP basis making it easier to move positions between CCPs if necessary.

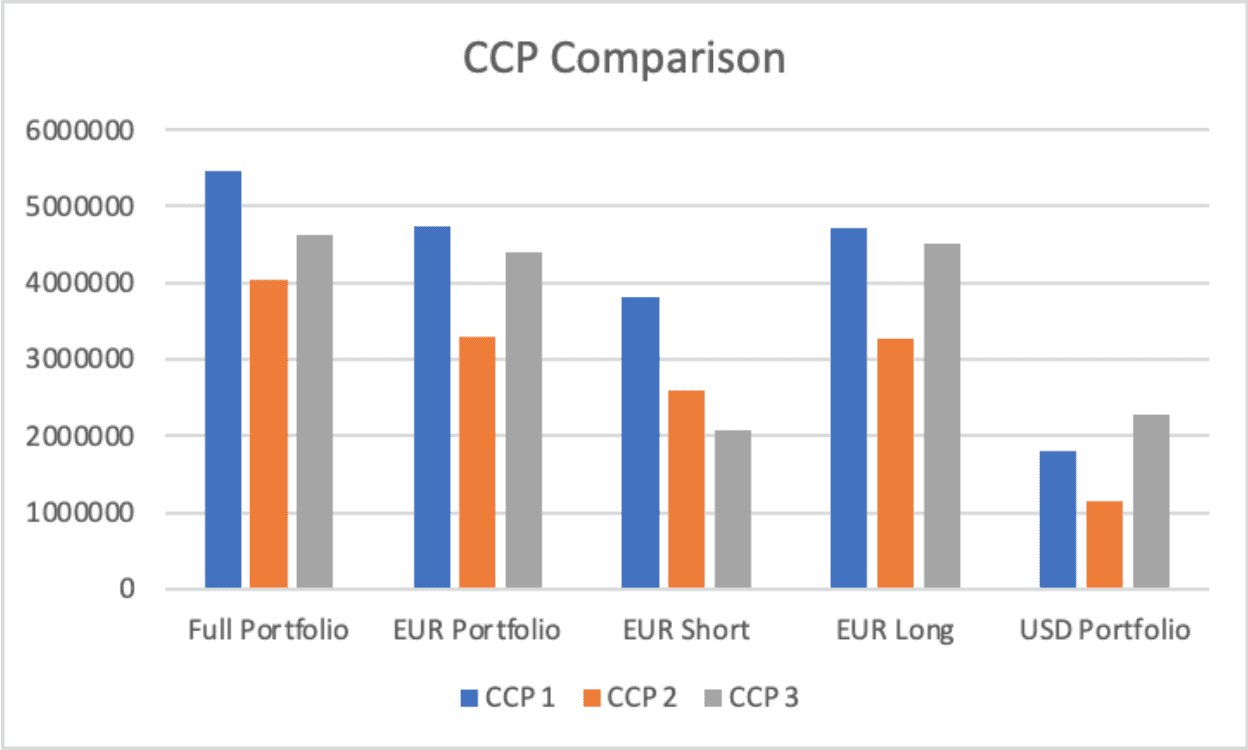

If making a choice of CCP then costs, including margin requirements, are going to be important. We took a quick look at current margin requirements across three of the large IRS clearing houses to see how the margins compare, using a range of test portfolios:

As can be seen there is a significant difference in the margin calculated by each of the CCPs, with a general pattern of CCP 2 requirements being lower for the chosen portfolios. However, this was not the case when the position consisted of only short dated swaps. And in other circumstances the picture for each CCP could be completely different.

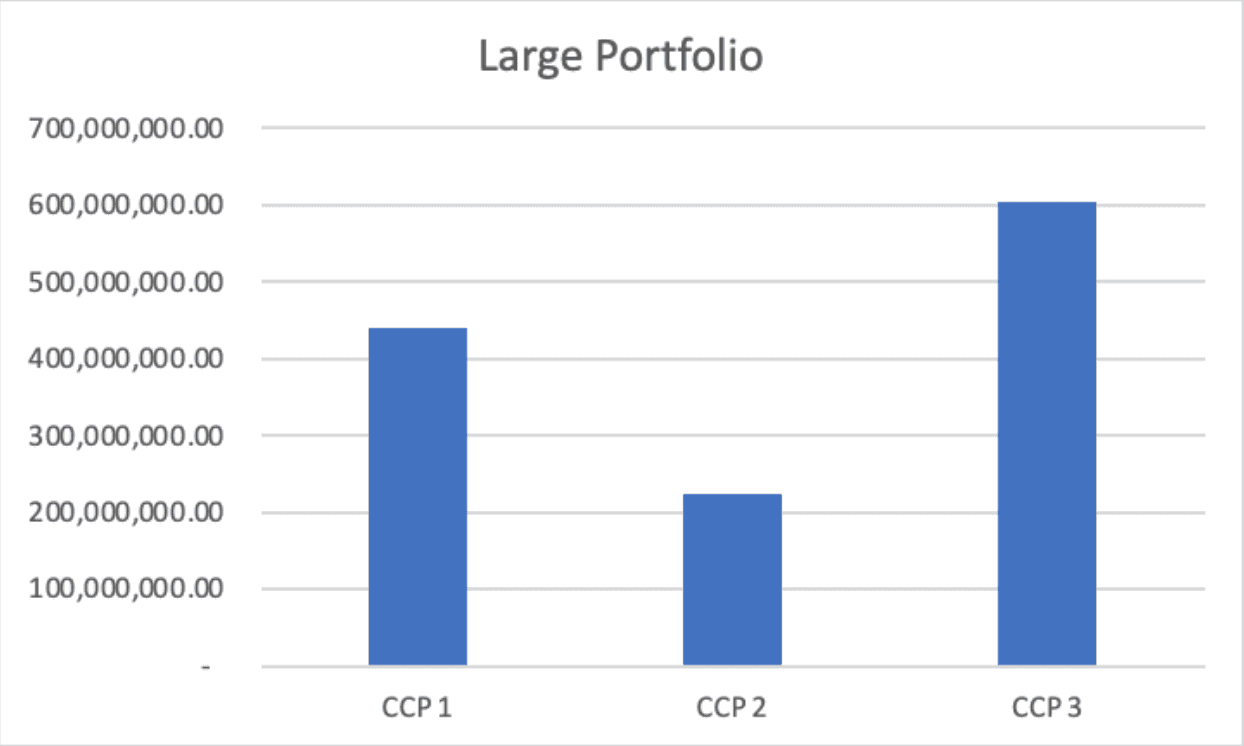

These were just small portfolios. We scaled up the notionals on each of the swaps 50 times so that we could see the impact of the liquidity charges that each of the CCPs applies.

As can be seen, once liquidity charge starts to be calculated then the balance between the CCPs changes and a different CCP 3, that had the lowest margin for the short dated position, has the highest margin requirement.

This analysis doesn’t take into account fees or collateral haircuts, which will also impact overall costs. And this is just a single day snapshot. Over time the balance will change, influenced by any updates that the CCPs make to their margin parameters, for example the confidence level that they use or the stress scenarios that they include within their calculations.