There have been some very worrying headlines lately about the rising cost of food, including (unfortunately) cocoa and coffee. That’s going to impact the cost of your favourite chocolate bar and morning wake-me-up. But it is also going to affect margin requirements if you trade these products.

What’s Been Happening?

Food inflation has been very high in a number of countries. In particular, production costs have risen, firstly due to the increase in energy costs following the end of Covid restrictions and then made worse by the Russian invasion of Ukraine.

The costs of commodities have also risen. Ukraine is sometimes called the breadbasket of Europe as one of the largest exporters of grain in the world, but shipments have been severely impacted because of the war.

Salad vegetables such as peppers, tomatoes and cucumbers have also seen price rises caused by adverse weather conditions in their growing areas in Europe and Africa, leading to supermarkets introducing limits on purchases.

Gas and fuel prices have now started to come down, leading to lower transportation and production costs, meaning that general food price inflation has started to fall. However, the cost of commodities such as coffee and cocoa has now jumped.

What’s Happened To Margin Requirements?

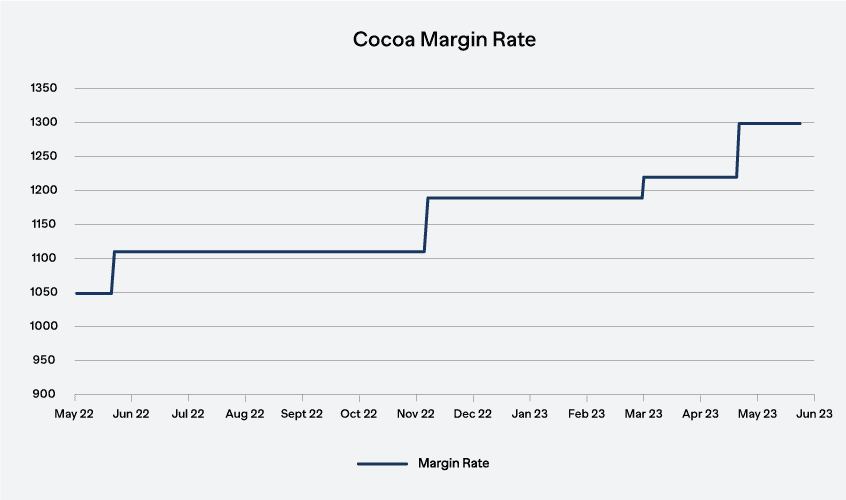

Over the past year, the price of cocoa has risen by about 25%. The following chart shows what has happened to margin requirements for the ICE Cocoa contract over the same period:

It can be seen that margin has similarly increased. In fact the margin requirement is now about 25% higher than it was a year ago.

For other contracts, particularly in the energy sector, where prices have risen the margin requirement has become a higher percentage of the contract value. The difference for Cocoa is that the price rise has been very steady with no real periods of high volatility. The margin increase is solely related to the increase in the value of the contracts.

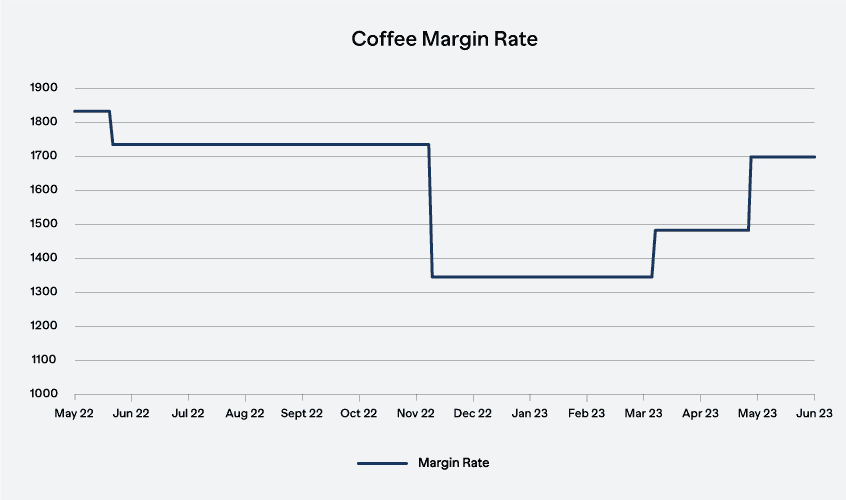

In the same timescale, Robusta Coffee prices have increased by just over 20%. However, unlike Cocoa where the rise was steady, Coffee prices actually fell before increasing again. Around Christmas prices were 17% lower than they were six months earlier. This is reflected in the margin changes that have been seen over the past year:

Interestingly, although the margin requirements have moved up and down with the prices, the margin rate as a proportion of value has not stayed the same. As a percentage of price it is now lower than it was this time last year, reflecting a reduction in the volatility of Robusta prices.

These two examples illustrate the difficulty in forecasting margin. Both price and volatility need to be taken into account when projecting margin rates and the way that they can impact future funding requirements.