Historically firms have not been too concerned about the level of Initial Margin they were being charged. If they didn’t have sufficient collateral to cover requirements it didn’t matter, as with interest rates close to zero it was easy to borrow the additional funds.

But now interest rates are higher and money is no longer cheap, firms need to ensure that they are not paying more margin than required. They need to ensure that they are making the correct choices in their trading to optimise the level of Initial Margin.

Firms need to show discipline to make best use of available funds, controlling costs under every scenario whilst allocating capital to the strategies that generate the largest ROI. But with margin models appearing to be a “black box”, this is easier said than done:

- Pre-trade – use what-if tools to aid trading decisions:

- Choose between equivalent contracts at alternative venues

- Select broker to maximise offsets and minimise liquidity charges

- Consider trading OTC rather than on exchange

- Post-trade – use rebalance tools to reduce Initial Margin:

- Suggest moves to express the same risk in a different form

- Determine trades that can be removed to give the largest reduction in requirements

- Monitoring – use attribution and explanation tools to understand drivers of Initial Margin:

- Allocate margin to traders and desks to drive behaviour

- Use breakdown of margin calculations to identify potential strategy changes

Pre-trade

When using what-if tools, traders are usually trying to ensure that they stay below limits. This is often a standalone calculation, but if it does try to assess the overall impact on the portfolio there is rarely consideration of where to place the trade.

However, by considering equivalent products on different exchanges, looking at the impact of placing the trade with different brokers or even assessing trading OTC rather than ETD, firms can potentially lower costs without impacting their trading strategies.

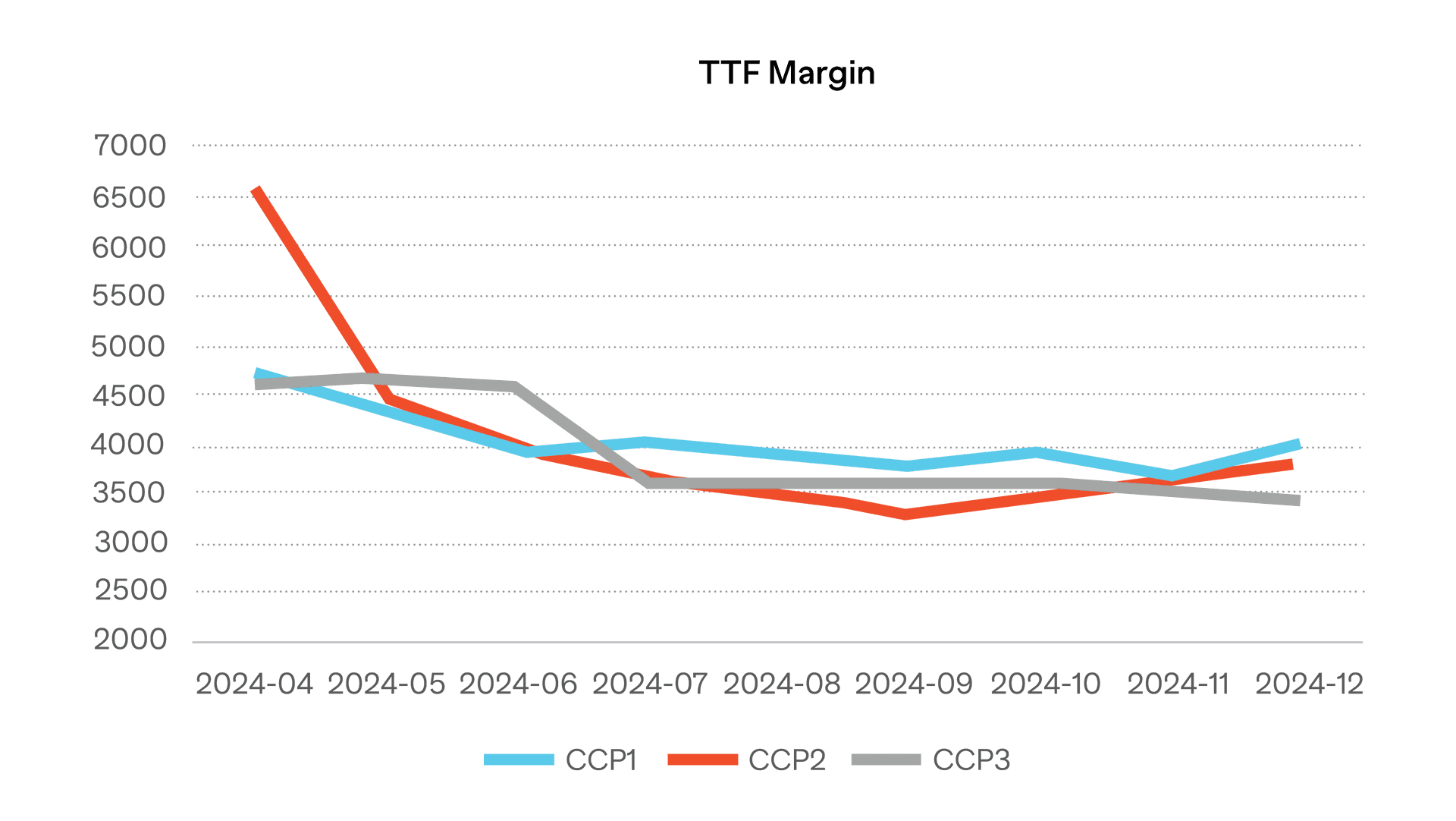

But this is not as easy as might be expected, as the margin calculated for Dutch TTF Natural Gas futures trading on Nymex, ICE and EEX shows:

Although the margin levels are relatively similar, the cheapest CCP can vary depending on the expiry. This is especially true for the front month, where the difference in margin is significant, with one CCP taking a more cautious approach to the risks of a position approaching delivery.

Firms need to understand the different structures of the products and the alternative Initial Margin algorithms. The methodologies used by the major clearers are all unique, and each will exhibit different behaviours that will impact the level of margin requirements, whilst trading OTC offers a choice between SIMM and Grid.

And any firm considering whether they are better trading ETD or OTC needs to be aware that by moving away from cleared derivatives they are exchanging Liquidity Risk for Counterparty Risk.

Post-trade

Making decisions of where and how to trade using what-if tools are good for minimising Initial Margin requirements at a point in time. But things change. The cheapest CCP may vary over time. The same is also true for the choice between ETD and OTC, with CCPs and ISDA having different cycles for their reviews of margin parameters.

The impact of new and expiring trades also needs to be taken into account. These can alter the offsets calculated by the margin algorithm and result in significant changes in requirements.

By using on-going analysis based on an in-depth understanding of margin methodologies and the availability of equivalent products on different venues, it is possible to determine trade moves that can be used to lower Initial Margin. Alternatively, savings can be made from the removal of specific positions where the level of margin that they attract does not justify the contribution that they are making to the portfolio either in terms of hedging or ROI. But, if making these moves, the costs of executing the required trades needs to be taken into account to ensure that these do not exceed the long term savings in margin funding costs.

Monitoring

Understanding the drivers of Initial Margin makes it much easier for firms to minimise the amount that is being paid. To do this requires the use of monitoring tools that can provide the required information:

- Attribution – allocate margin to positions based on a specific factor such as trader or desk.

- Explain – show a breakdown of margin by specific groupings

Attributing margin is difficult because of the non-additive nature of Initial Margin. Each firm will have their own view of how this should be done, with very different results depending on the methodology chosen, as can be seen below:

| Attribution Type | Initial Margin | Netting Benefit |

| Standalone | 36,816 | 0 |

| Weighted | 14,472 | 22,344 |

| Marginal | 104,843 | -68,026 |

How To Implement Discipline

With the end of cheap money, firms need to ensure that they show discipline when deciding what and where to trade. By making the right choices it is possible to significantly reduce Initial Margin and therefore funding costs.

However, with the black box nature of some Initial Margin methodologies and the range of different algorithms that need to be supported to perform the required analysis, firms need to consider using a solution that can provide all the required functionality:

- Pre-trade what-if tool to allow Initial Margin to be compared between trading equivalent products in different markets or placing business with different brokers.

- Post-trade optimisation that considers the reduction in Initial Margin that can be achieved by moving trades to a new venue or removing trades from a portfolio.

- Monitoring that can be used to understand the drivers of Initial Margin, including attributing margin at different levels to encourage trading behaviour to minimise costs.

If firms can optimise the level of Initial Margin they are charged, then the impact of the end of cheap money will be reduced. They can make best use of their available funds ensuring they achieve the highest possible ROI.