The State Of French Nuclear Reactors

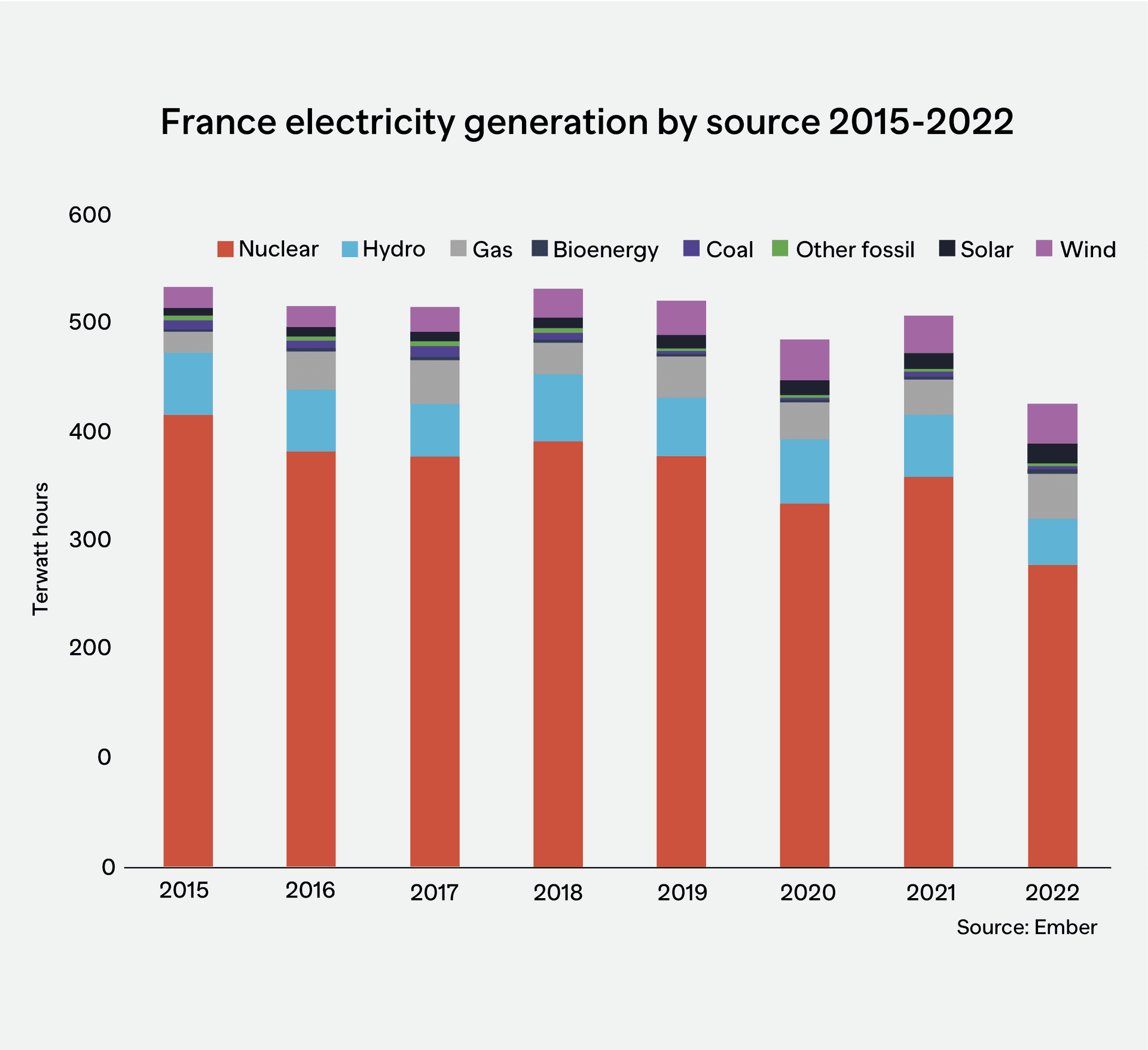

France is a major nuclear power producer, with over 50 nuclear reactors in operation. However, in recent years, the country has experienced a number of disruptions to its nuclear power production, which have had a significant impact on power prices.

One of the main reasons for the disruptions is the age of the French nuclear fleet. Many of the reactors are over 30 years old, and they are starting to show their age. Another reason for the disruptions is the rising cost of nuclear fuel. The price of uranium has increased significantly in recent years, and this has put a strain on the French nuclear industry.

Planned maintenance shutdowns and unplanned shortages of reactor cooling water resulted in a 23% cut in French nuclear electricity generation, forcing utilities to drastically adjust their power fuel mix by increasing imports and natural gas use by nearly 30%.

Recent Strikes Have Exacerbated the Problem

In addition to the ageing of the French nuclear fleet and the rising cost of nuclear fuel, recent strikes have also exacerbated the problem. In January 2023, French unions went on strike over planned pension reforms. The strikes lasted for several weeks and forced the closure of several nuclear power plants. This led to a significant drop in nuclear power output and an increase in power prices.

The strikes have raised concerns about the future of the French nuclear industry. It is unclear how long the strikes will last or what the long-term impact will be. However, it is clear that the strikes have created a great deal of uncertainty in the French energy market.

Liquidity Concerns for Energy Providers

The disruptions to nuclear power production in France have had a significant impact on power prices. In 2022, the average price of electricity in France was 20% higher than it was in 2021. This is a major burden for French consumers, and it is also a threat to the country’s economic competitiveness.

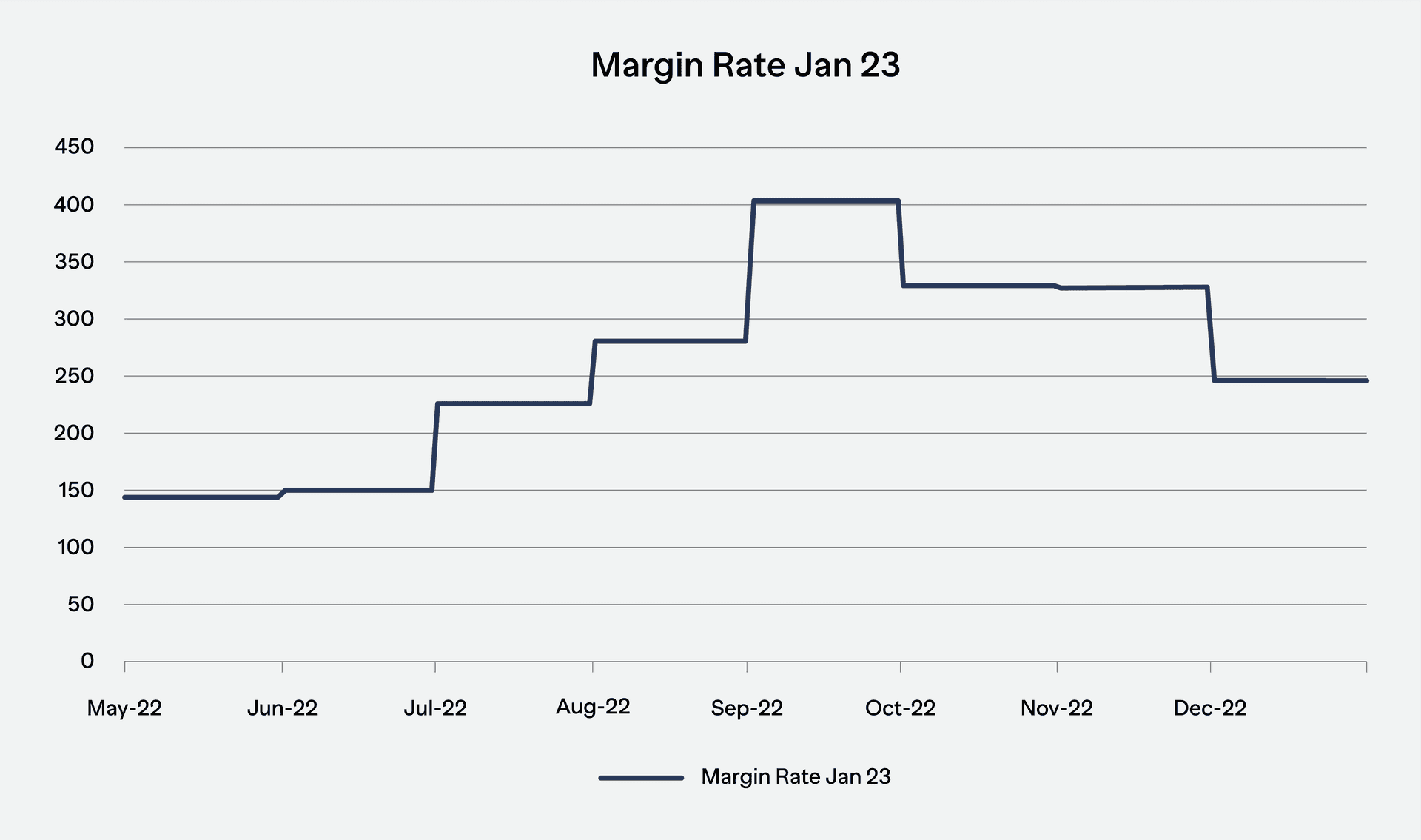

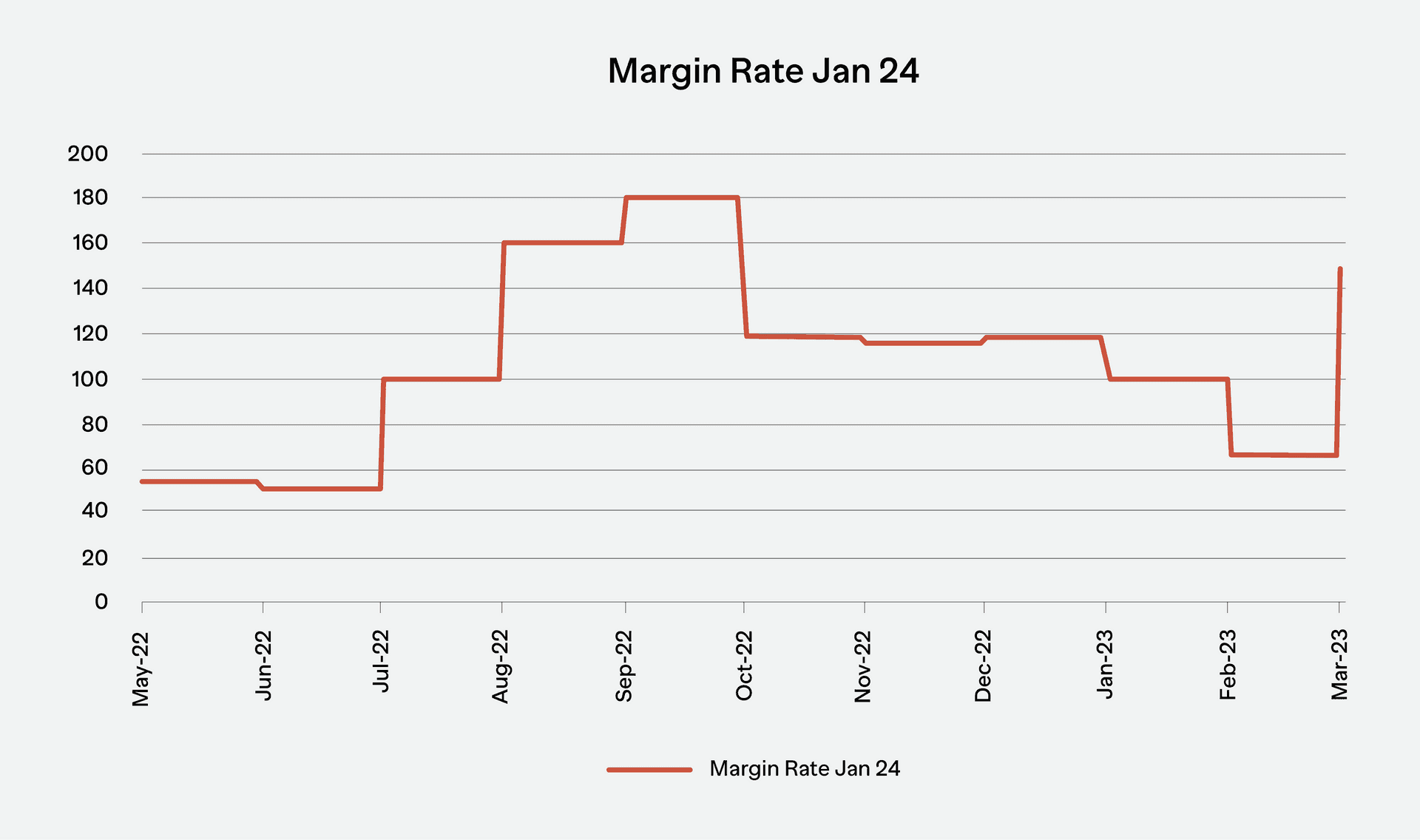

The volatility in power prices has also created liquidity concerns for energy providers who use derivatives to hedge. Whilst French power winter prices have come down relative to last autumn when they traded above Eur1,000/MWh (resulting in margin rates above €400) due to lower gas prices and EDF’s ability to return reactors to generation, there is ongoing concern that the delayed maintenance as a result of strikes will result in high prices and volatility, which would lead to a drastic increase in initial margin rates.

Contagion Risk

The reduction in France’s nuclear power output in 2022 created ripples in all of Europe’s energy markets as France flipped from being a net exporter of energy to being a net importer, for the first time since 1980.

This created volatility in neighbouring countries that rely on French nuclear output for their power imports. There is a concern that the lower output so far in 2023 will lead to renewed volatility not just in France, but in power markets across Europe, which in turn would lead to liquidity challenges for a number of energy providers.

The power industry is a complex one with many inter dependencies. There is often talk of the impact of weather or major events, such as the Russian invasion of Ukraine, on power prices, but the issues seen with French nuclear power production show that there are many other factors that can impact market volatility.

For power derivatives it will not just be the outright margin that changes. The offsets allowed between the different countries or hubs will also be impacted. This can result in significant changes in margin that can be difficult to understand without having the right tools available that can help explain initial margin by breaking it down into its component parts.