The metals industry has witnessed an influx of bullish investors, with record-breaking highs across the sector. These investors – not just your typical commodity trading firms, but algorithmic traders, specialist commodities investors and macro funds – are betting on upcoming shortages in supply whilst trying to capitalise on the volatility, using commodities futures to get exposure to de-globalization, decarbonisation and hedging against geopolitical risks and inflation.

Commodities prices are impacted by three main drivers – supply, demand and momentum. We are seeing this across the metals industry right now.

Supply

Supply disruptions have caught out copper traders globally, seeing them running to avoid losses on their short positions and closing out their contracts. Across the global copper market, a race is unfolding to secure metal to deliver to the exchange ahead of expiry.

Long term, supply concerns are extremely valid. There have been multiple mine disruptions and closures over the past few years. If the copper prices remain high, it will most likely trigger new mines to develop, but this could take over 15 years for one to be fully operational. Therefore, boosting supply in the short term cannot happen.

BHP’s attempt to acquire its rival Anglo American to secure their copper mines signalled to investors to continue on their bullish trend. It shows how much easier it is to buy a competitor and take over their mines than build a new mine. But this doesn’t increase overall supply.

Demand

An increasingly electrified world means the demand for copper is growing day on day, with its use in renewable energy plants, electric vehicles, data centres and power cables. This is why futures traders are predicting a longer term huge demand for copper.

However, China has shown weaker than expected demand due to their rapid build-up of metal stocks and a lack of willingness to buy at higher prices. This has been reflected in the Shanghai Grade A Copper Cathode Premium, typically used as the barometer for Chinese demand for imported copper. Prices recently fell to an all time low. At the same time, inventory registered with the Shanghai Futures Exchange (ShFE) rose to nearly 300,000 metric tons, almost 3 times the stock in LME warehouses.

Momentum

Copper is being named as the “next oil” as it is mirroring oil’s rise in its earlier decades. There has even been suggestion that the price could nearly quadruple to $40,000 a tonne over the coming years due to soaring demand.

Speculation has sent metal prices soaring. Copper has climbed 30% since early March to over $11,000 per ton, an all time record. This has been reflected in futures prices at LME. COMEX and Shanghai where new highs have been reached.

Other metals are also climbing, including gold, which reached an all-time high recently, whilst silver topped $30 per ounce for the first time in a decade. Nickel has also seen large increases of around 8%.

But the price increases have not all been consistent. The spread between LME and COMEX copper futures rose to nearly $1,000 per ton, where it is usually less than $100. The COMEX price shot up first as prop traders and hedge funds are more active on this market. The LME copper price took days to react because the market is mainly used by physical producers and consumers. This created an arb opportunity, but prices have now realigned.

As more varied participants move into commodities we are likely to see more of these spikes, and taking account of the types of traders in certain markets will become important. On the whole this new dynamic will lead to more uncertainty and potential price volatility.

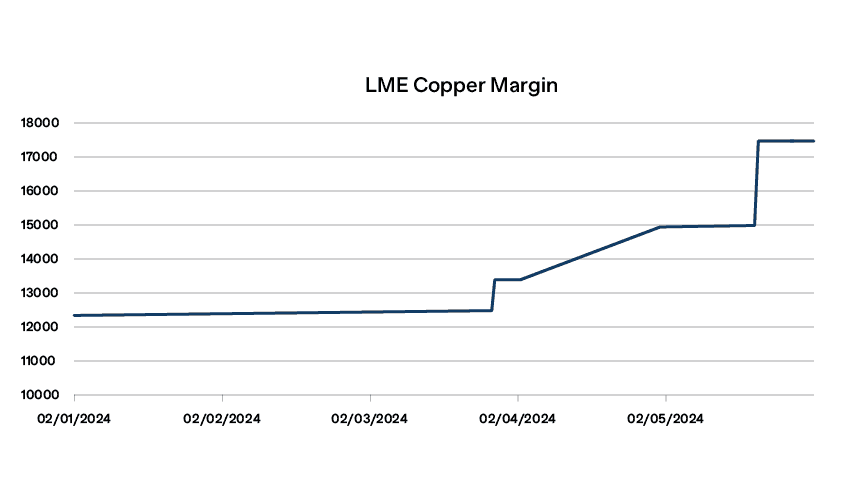

The Impact On Margin

At the beginning of May, the Initial Margin requirement for near dated copper on LME stood at around $15,000. On the 21st May this increased to closer to $17,500, a 17% increase.

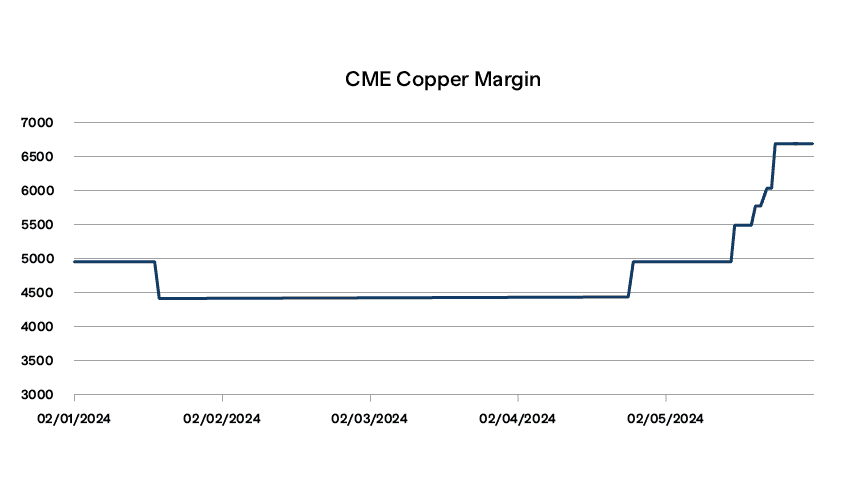

The COMEX copper contract is a smaller contract with risk calculated using a 1 day Margin Period of Risk, based on US regulations, and therefore subject to lower margin requirements. At the beginning of May the CME Initial Margin for the June contract was $4,950 per lot, but on the 22nd May this had increased to $6,050, an even larger increase than LME of 22%.

At the same time, as front-month contracts surged toward record highs, traders and firms were exposed to significant Variation Margin calls against their portfolios forcing them to buy back copper futures to cover positions.

Conclusion

Increased electrification means that the demand for copper is growing. At the same time, supply issues are likely to continue, leading to reduction in stocks and pressure on prices. And now new participants have started trading copper futures, which were previously dominated by producers and consumers.

This combination of rising demand, supply shortages and additional trading is a perfect storm. The market is likely to see increased volatility going forward, and this will be reflected in increased margin requirements. With the end of easy access to cheap money, firms should be looking to techniques such as Stress Testing and calculation of Cash Flow at Risk to ensure they have sufficient cash available to provide the flexibility required to meet margin calls.