Trading commodities is capital intensive, and one of the largest and least predictable costs is funding margin. As a result, margin efficiency has become a competitive necessity. Achieving it, however, requires firms to navigate fragmented markets in which the same or similar products trade across multiple trading venues, each being subject to their own margin algorithm. Because margin is typically calculated using portfolio-based algorithms, netting benefits are lost when positions are spread across exchanges, cleared through different brokers or split between cleared and bilateral trading.

However, this fragmentation also provides opportunity. A combination of the optimal choice of product and venue can significantly reduce margin requirements for the same level of risk, with savings of over 30% being possible.

In this piece we look in more detail at how using OpenGamma to optimize margin can help energy firms trading across markets reduce margin requirements. We consider specific examples to illustrate the savings that can be achieved, based on the recommendations provided by our tooling, such as changing trading venues or adding an additional clearing broker.

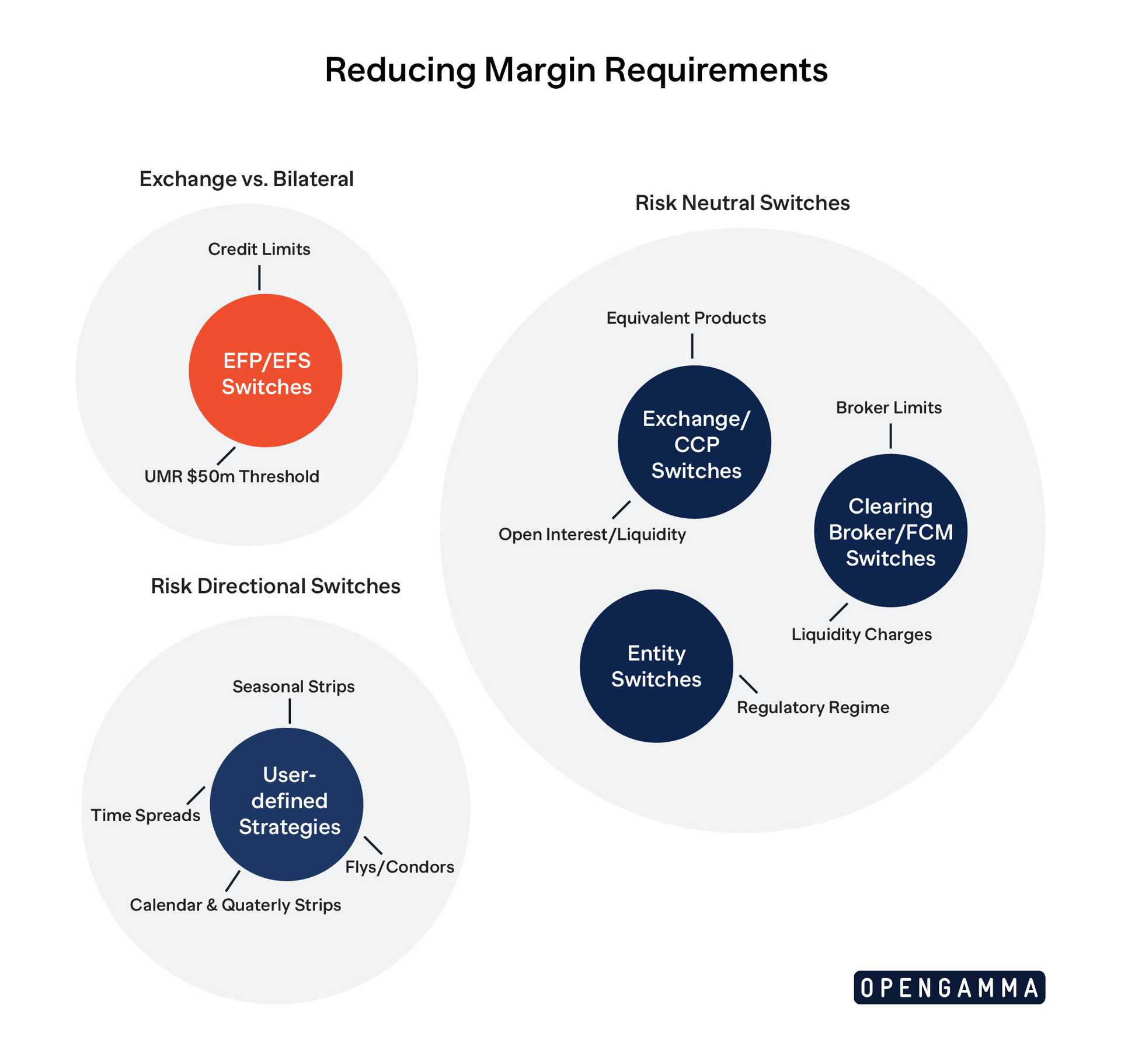

How to reduce the level of margin requirements

Recent market conditions have left some commodity traders unable to put on new positions or forced to close out existing ones because of limited liquidity to cover margin requirements.

However, there is an alternative. While firms must still decide the amount of risk they are willing to accept, margin requirements can be optimized to maximize exposure using the same available collateral.

- Exchange vs Bilateral

- Trade EFP/EFS switches to benefit from lower or zero margin on bilateral positions

- Where applicable, keep exposure within the $50M Uncleared Margin Rules (UMR) threshold, eliminating the need to exchange margin.

- Risk Neutral Switches

- Trade equivalent products across different exchanges, accounting for portfolio offsets differences in margin methodologies.

- Select the broker or FCM that maximize offsets and minimize liquidity charges on large positions.

- Allocate trades to entities operating under more favourable regulatory regimes, such as longer margin holding periods or lower capital requirements.

- Risk Directional Switches

- Maintain similar risk exposure through alternative structures, such as seasonal calendar strips, time spreads, flys or condors.

Below will look at examples of some of these optimization opportunities and the potential reduction in requirements.

Same product using alternative venues

Many commodities trade across multiple venues while offering effectively the same exposure.

For example, TTF gas futures are listed on ICE, EEX, Nasdaq and CME, with differences in contract designs such as physical delivery vs. cash settlement. Brent and WTI futures trade on both ICE and CME, though liquidity and open interest vary by venue.

Despite the underlying exposure being equivalent, and margin frameworks being governed by the same or similar regulation, margin requirements can differ materially between markets.

Example

The following table shows example margins calculated on Dutch TTF Gas futures at different CCPs.

| Expiry | CCP1 | CCP2 | CCP3 |

| Dec 2026 | €1,688 | €1,780 | €1,719 |

| Dec 2027 | €982 | €1,149 | €1,168 |

| Dec 2028 | €644 | €818 | €1,183 |

It can be seen that where CCPs stand in relation to one another is dependent on the expiry of the future. For example, margin at CCP3 is less than CCP2 for a Dec 2026 future, but more than CCP2 for a Dec 2027 or Dec 2028 future.

And looking specifically at the margins calculated, for a Dec 2028 contract this could mean a difference in margin of over 80% between CCP1 and CCP3.

Same risk using alternative products

There are multiple ways of trading the same level of risk, each of which can have a significant impact on the level of margin required or the timing of any cash flows. Both factors directly influence liquidity requirements. For instance:

- Different product types can be used. For example, options can be used to simulate a future position.

- Cash-settled or deliverable derivatives may be available for the same underlying.

- Cleared and bilateral options may exist for many of the same products..

In some cases, the difference in margin across these alternatives are small, but in others they can offer substantial savings.

For some bilateral trades no margin will be required, making it a significantly cheaper option. However where trades are subject to UMR, if you’re outside of the $50M threshold, margin requirements can exceed those calculated for cleared trades with differences of more than four times often seen.

Same portfolio using alternative clearers

Choosing where to place your cleared business can have a significant impact on the margin charged. Optimising the level of broker costs is obvious, with each having its own schedule of charges and in some cases their own margin algorithms. But if they are replicating the CCP margin calculations they will also have varying multipliers that will be applied.

Aside from differences in algorithms or multipliers, broker selection can impact margin levels in two key ways:

- Existing Positions: Considering existing positions held with the broker is important so that any offsets can be maximized.

- Position Allocation: The largest savings can be achieved by splitting positions between brokers to minimize the liquidity charge.

Example

With the introduction of the non-linear liquidity add-on, the traditional way of allocating business between clearing brokers – putting all positions from one market at the same broker – is now suboptimal. Any large outright position will incur significant margin in order for the CCP to cover the risk of close out on default. If you allocate your trades by market it may give the maximum position offset, but also maximum liquidity charge.

Assume you have a position in ICE TTF and allocate it all to a single broker:

The initial margin calculated would be as follows, based on different sizes of positions:

| Position Size | Initial Margin | Effective Margin Rate Per Lot |

| 40,000 Lots | €31,600,420 | €790 |

| 30,000 Lots | €21,499,810 | €716 |

It is clear that the larger the position the higher the effective margin rate per lot. A more efficient way of allocating positions needs to be found which will minimize the margin calculated by clearing brokers. This means not just maximising the offsets between contracts but also minimising positions for a given product allocated to a broker.

Placing a maximum of 10,000 lots at any given broker would significantly reduce the total margin paid. The margin on a 10,000 lot position would be €6,443,324 which would result in the following initial margin:

| Position Size | Number of Brokers | Total Initial Margin | Initial Margin Saving |

| 40,000 Lots | 4 | €25,773,296 | €5,827,124 |

| 30,000 Lots | 3 | €19,329,972 | €2,169,838 |

For the larger position this is a margin saving of around 20% and the larger the position the higher the savings will be.

Conclusion

Commodity trading firms rely on derivatives alongside physical positions, with most trades subject to margin. Although market volatility may have eased, ongoing geopolitical uncertainty, climate-related risks and the continued expansions of mandatory clearing increase the likelihood of further margin pressure.

To prevent margin from becoming a drag on returns, firms must actively optimize their requirements. Choosing where and how to trade can materially reduce margin while controlling liquidity risk. Firms using OpenGamma have achieved consistent reductions in margin requirements, with savings of more than 30% regularly attainable.

To find out more, get in touch with the team at info@opengamma.com and schedule a demo today.