Dated Brent is used as a reference price for around two-thirds of global oil trading and underpins the Brent futures market. The way that the Dated Brent price has been derived has changed over the years. Assessment started in the 1980s and at that time was based on just the Brent field, but during the 2000s additional sources were added, although all based in the North Sea.

Originally prices used in the evaluation were all FOB (free on board), but in 2019 CIF (cost, insurance,freight) Rotterdam deals were added to increase the number of quotes available for consideration, with an adjustment formula implemented to convert them to FOB equivalent prices.

Now perhaps the biggest change ever is about to go live, helped in part by the introduction of CIF Rotterdam trades into the evaluation. With effect from June 2023, the standard will include WTI Midland Crude deals that meet certain criteria, including delivery from approved Gulf Coast terminals.

The Midland prices are unlikely to be the cheapest, given the cost of shipping from the US to Europe. But since the Russian invasion of Ukraine, the US has become the supplier of choice for European buyers, especially as the amount of available North Sea oil has reduced.

What Does That Mean For WTI and Brent Margins?

The two biggest oil futures contracts at the moment are Brent Crude, mostly traded on ICE, and WTI Cushing, mostly traded on Nymex and cleared through CME.

WTI Midland volumes are small by comparison on the listed markets. At CME it is traded as a spread from the larger Cushing contract, having about 15% of the volume of the standard WTI future. At ICE there is a small amount of open interest in an outright future.

There are various views on how the introduction of WTI Midland into Brent Dated prices could impact these markets. Some feel that it will lead to better integration of the two global benchmarks of WTI and Brent, and could result in a move of US oil pricing away from Cushing towards the Gulf Coast.

Others feel that the inclusion of WTI Midland in evaluating Dated Brent could lead to increased price volatility and that the US oil price could dominate the evaluation.

Whatever happens, there is likely to be an impact on the way products are traded. In particular, there may be more trading of some of the spread products that are based on the difference in price between venues.

And What Does It Mean For Margins?

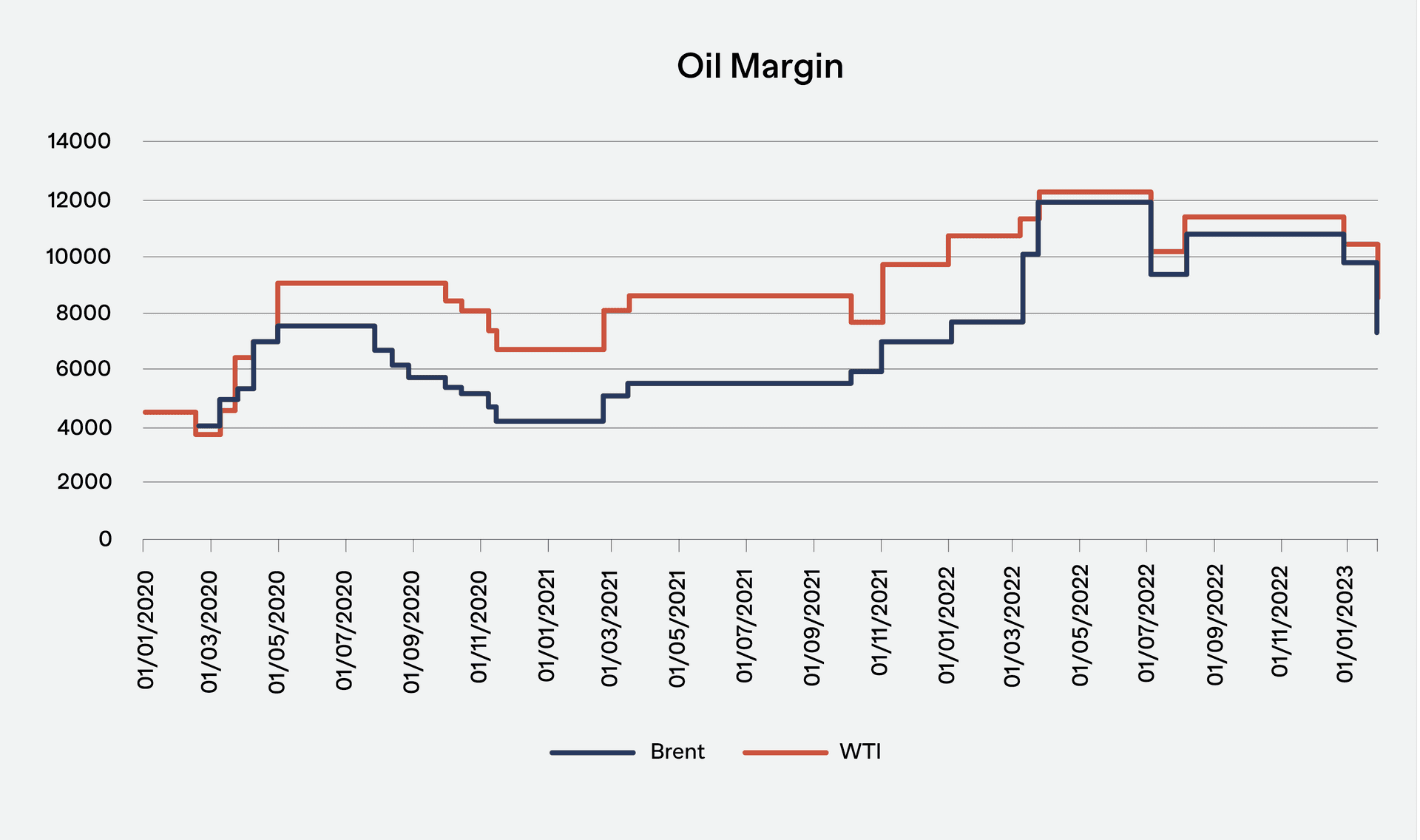

The following chart shows how margins for WTI and Brent have been affected by recent volatility in the oil markets:

Any increase in volatility caused by the way in which Dated Brent prices are set is likely to lead to equally volatile margin levels, which can make it difficult for firms to manage their liquidity requirements.

If firms find themselves trading more spread products then they will be exposed to some of the more complex aspects of the margin algorithms. Most include an initial step that breaks down these products into their constituent parts before performing the main market risk based calculations. This can be hard to understand, and even harder to replicate. Which means understanding the impact of new trades on margin requirements is going to be difficult to achieve.

And it’s not long before CME will move their oil margin calculations onto SPAN 2 – their VaR based methodology. ICE on the other hand are prioritising other markets before moving their oil markets to IRM 2 – their own VaR algorithm. This could make it even harder to decide how best to optimise the margin costs of the trading opportunities that the changes to the way that Dated Brent prices are determined may bring.