Having dealt with a challenging 2018, Asset Managers face an uphill slog towards the year 2021. After seeing an encouraging 12% rise in Assets Under Management (AuM) in 2017, last year saw a drop of 4% caused by diminishing global growth and the increased pressure of new financial policy.

Additionally, the next three years will see the introduction of a plethora of rules and regulations that will make trading more expensive and more operationally complex.

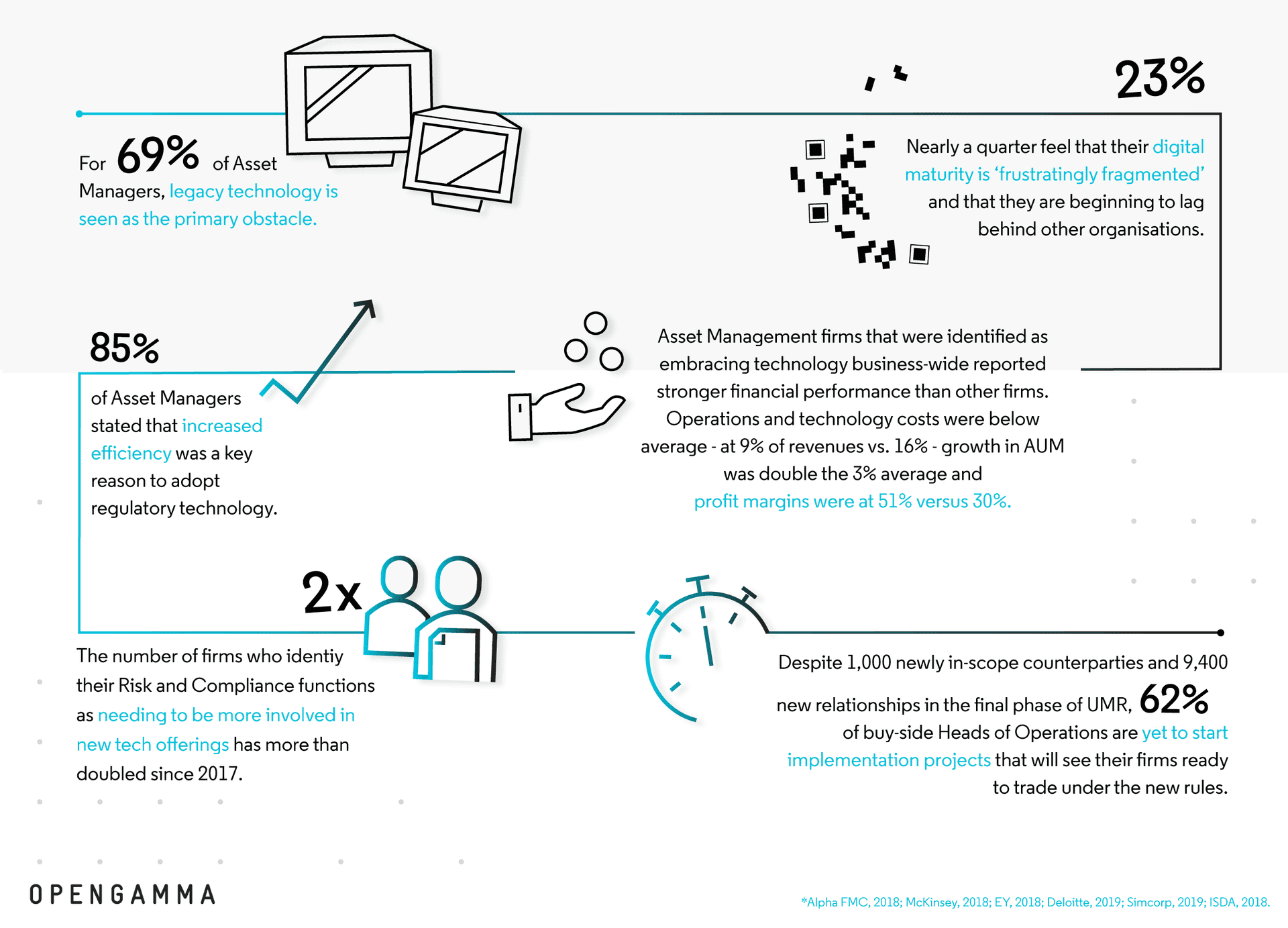

Asset Managers have previously shown trepidation in acting quickly and proactively addressing tomorrow’s challenges using today’s technology. This has been, and will continue to be, a deciding factor of success over the next few years.

It’s already driving a performance gap between firms, so how firms approach the threats they face in 2020 will decide which side of this gap they fall.