Fragmentation is a problem for traders. They need to determine the best venue to place a trade and potentially decide between cleared and bilateral. Usually this decision is based on available liquidity and best price. But with margin levels for some products having hit historic highs in recent times, it is important that these are also included in the decision as the costs can be significant.

The problem that this causes is two fold:

- Each different trading venue potentially means a different Initial Margin calculation that needs to be considered in order to understand the potential funding cost.

- The fragmentation can also mean that any offsets in a portfolio are subject to a different algorithm and therefore potential reductions in margin are not applied, even though the overall risk of a position may be low. In effect, a gross margin is being calculated.

There are a number of ways that fragmentation in trading can occur:

- Choice of exchange – the same or similar products may be listed on multiple exchanges.

- Choice of broker or clearer – most firms have arrangements with more than one broker.

- Cleared or bilateral – whether margin is calculated or not and the timing of any cash flows varies considerably between the two alternatives.

We discuss how each of these can impact margin calculations.

Choice Of Exchange

Many contracts are available for trading on multiple markets. Usually one exchange will initially list a product, but once it gets traction and becomes popular then a rival exchange will often step in to grab some of the liquidity.

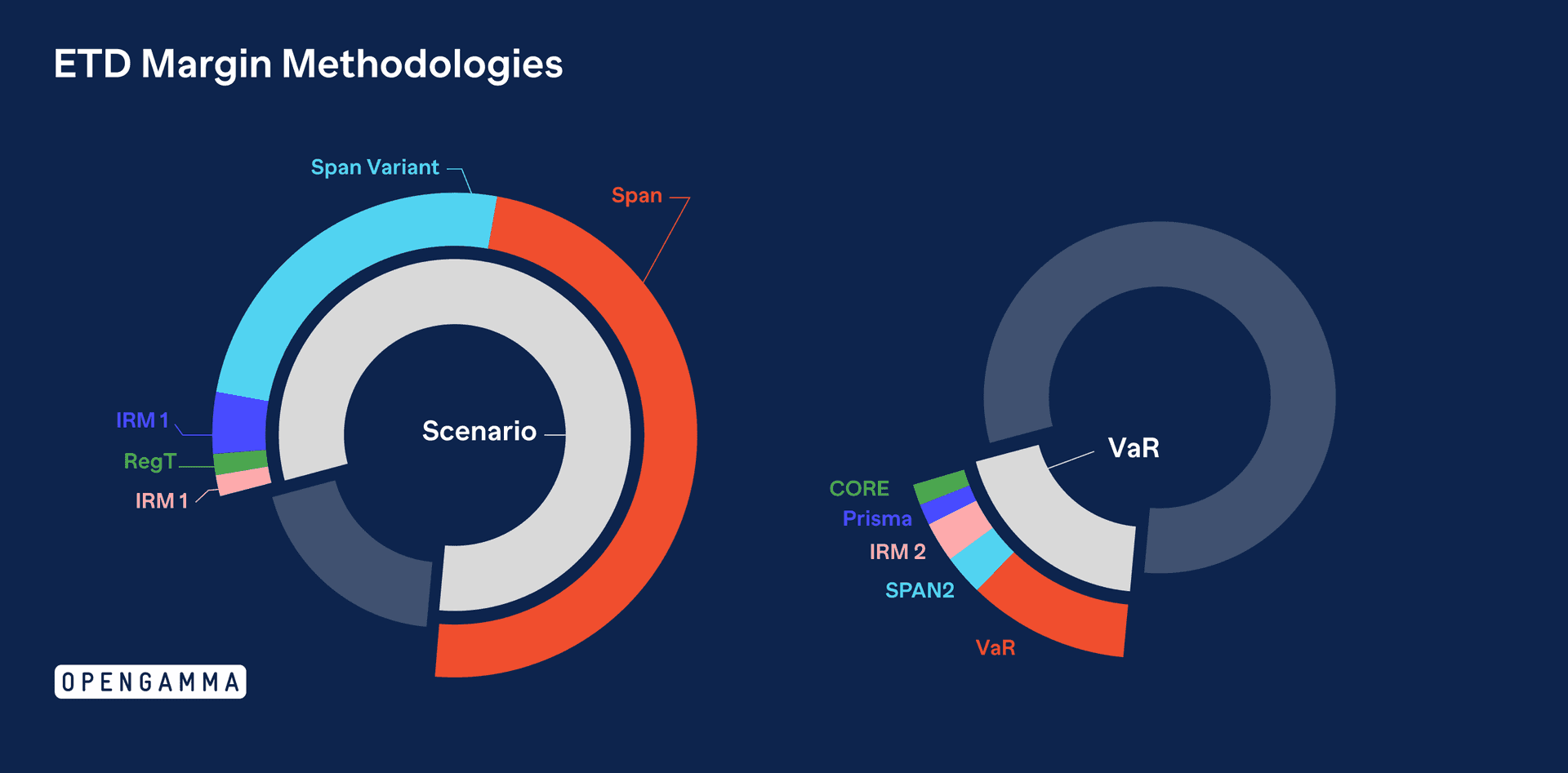

Examples of products available for trading on multiple exchanges include Brent Crude and WTI, various short term interest rate and bond contracts, as well as some equity index futures and options. These contracts may have the same specifications, but the algorithms used to calculate initial margin requirements can vary considerably.

Dutch TTF gas is one product that is available, and widely traded, on multiple exchanges. However, each uses a different margin methodology that can result in widely varying requirements:

- ICE – the methodology used is IRM 1, a SPAN like scenario based methodology. The Scanning Risk (the main margin parameter) is set as an absolute rate, so the same value applies regardless of the underlying price. In the near future, this calculation will be replaced by IRM 2, ICE’s bespoke VaR based methodology.

- EEX – the SPAN methodology is also used by ECC (the clearing house for EEX), but the Scanning Range is set as a percentage of value so that the requirement will change depending on the underlying price. ECC is now part of the Eurex group and SPAN will be replaced by their VaR based methodology, Prisma, at some point in the future.

- CME – SPAN used to be the methodology for calculating the margin on CME, but this was changed relatively recently to SPAN 2 , CME’s own VaR based methodology.

This is for open positions in the TTF contract. In addition, each CCP charges a different delivery margin and has a different payment schedule during the delivery period.

These different margin algorithms mean that the level of requirements varies between CCPs. To make things more complicated, this variation is not consistent across expiries, so the cheapest CCP can change over time as contracts move towards delivery. Also, where the margin parameters are set based on a percentage of price rather than as an absolute value, then the cheapest CCP will be dependent on the current market.

The impact of trading different parts of a strategy at different exchanges must also be considered. The price on one exchange may be better than the other for a new part of the strategy, but if a margin offset is lost by not trading everything at the same venue then this could be very expensive in margin funding costs.

Choice Of Broker Or Clearer

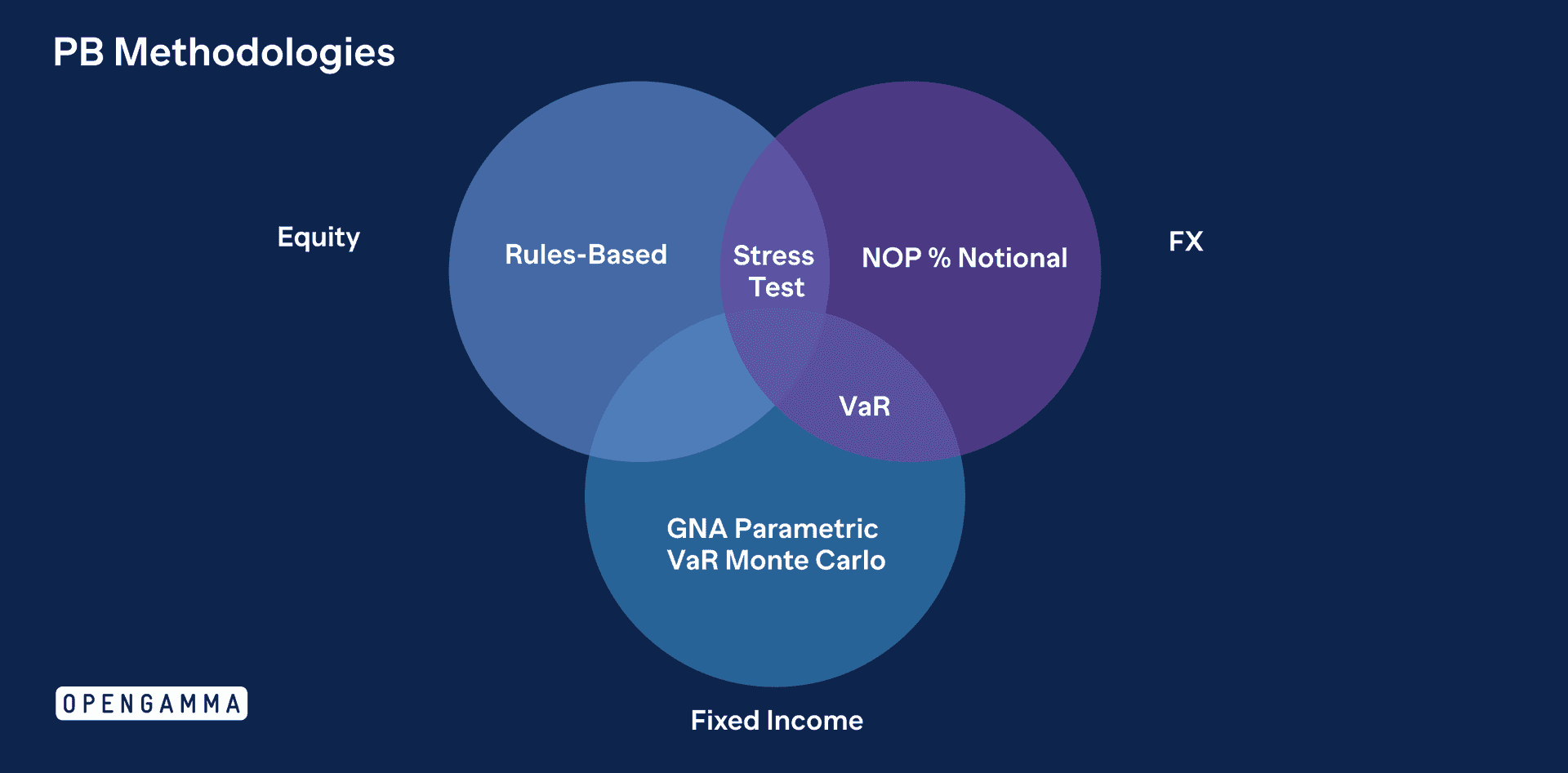

The CCP methodology isn’t the only thing that can impact margin requirements. Many firms are charged based on a broker specific methodology and, as with the CCP algorithms, each will result in a different level of margin. These calculations may use a simple schedule or may be based on a more complex stress style algorithm. It is easy to see how trading at the same venue but making a different choice of clearer can significantly impact the margin funding costs.

This issue also adds to the difficulty of understanding the impact of trading on margin requirements. It increases the number of margin algorithms that need to be supported, and it doesn’t stop the need to support the CCP methodologies as these are often used as a minimum based on regulation.

Knowing where each algorithm offers offsets is also important. One methodology may provide benefits for opposing positions in different correlated products whilst another may only consider positions in different expiries of the same product. If an offset is available then it is always best to make sure that both sides of the spread are placed with the same broker in order to benefit from the margin savings.

Whether to place all trades for a particular product with a single broker or not is also important. Most CCP algorithms include a liquidity or concentration add-on, where additional margin is calculated on large positions. In this case, there can be a benefit in splitting a position between multiple brokers. However, it could be that there is a volume based discount on other broker charges so there will be an optimum placement of trades to minimise overall costs.

Cleared Or Bilateral

It is often possible to trade the same or similar products either as cleared products or bilaterally. However this can completely change the overall risk profile of the trade, so although there are potential cost savings alongside the additional trading opportunities, the full picture needs to be taken into account.

When trading bilaterally, it is often not necessary to post Initial Margin. This may seem like an advantage as costs are reduced, but the liquidity risk from possible margin calls is replaced by credit risk.

Other bilateral trades, depending on the product and the size of the counterparties, may be subject to the Uncleared Margin Rules (UMR). In most instances there will be a $50M threshold before margin needs to be exchanged which can mean that these trades are still requirement free.

However, if this threshold is breached then margin will need to be paid, calculated using either the Grid or SIMM methodology. The bad news here is that the level tends to be higher for bilateral trades compared to cleared, especially as the available algorithms are not good at allowing offsets between correlated trades.

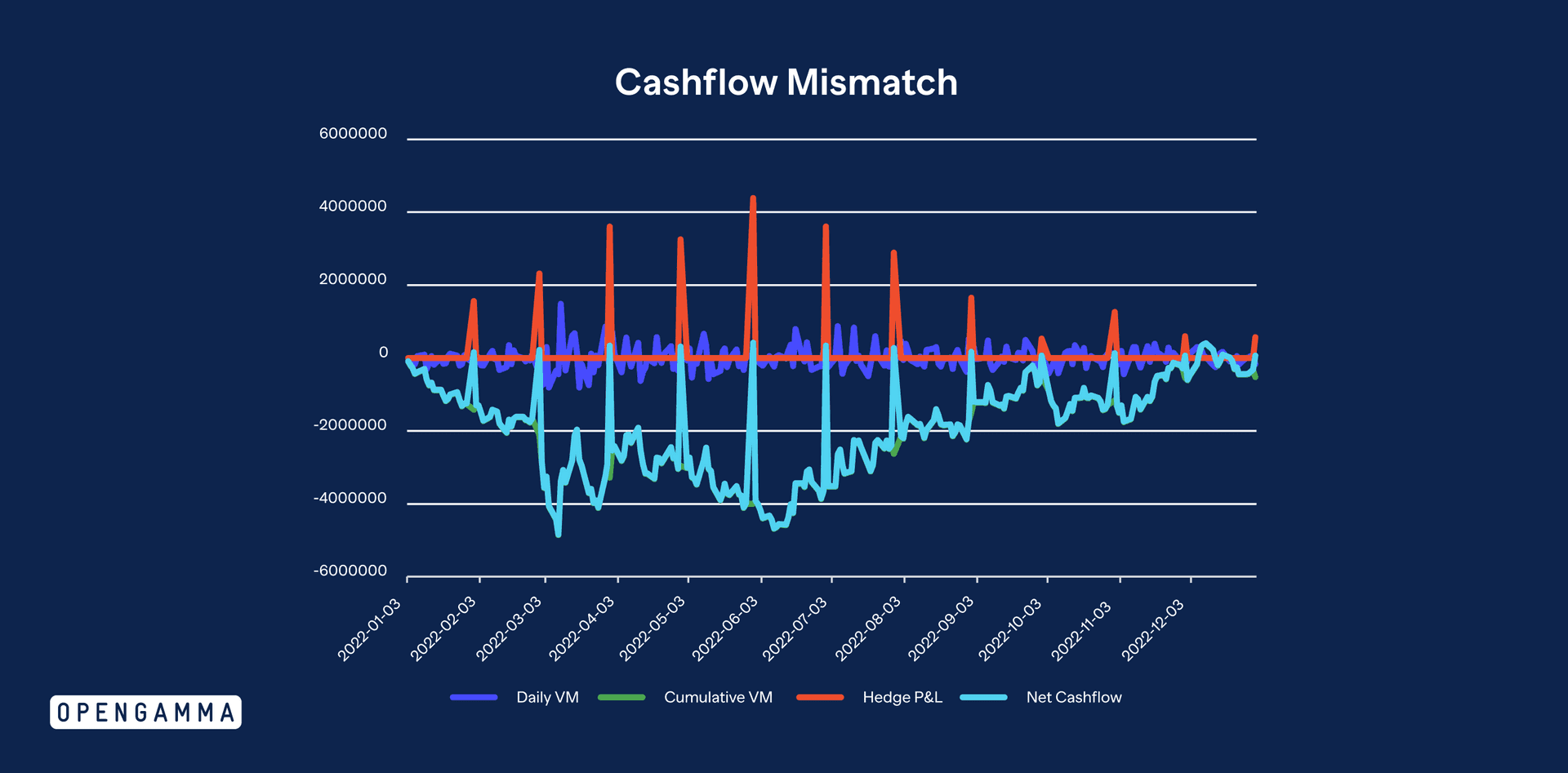

If the decision taken is to trade a mixture of cleared and bilateral, balancing the different risks involved can be tricky. In particular, there can be an unexpected liquidity issue. For most cleared products, profits and losses are paid daily in the form of Variation Margin. The same is not true for bilateral trades, where profits and losses are paid on key contract dates, for example quarterly or on delivery. This can be a significant problem in volatile periods where large losses could be being paid out without being able to crystallize the profits on the other side of a hedge.

Conclusion

Fragmentation can make it difficult to understand the full cost of trading. Firms need to include Initial Margin in their calculation, but this is not easy and requires a solution that can support a large range of functionality.

Every market has its own margin algorithm. Historically ETD markets were dominated by SPAN and other similar scenario based methodologies. However, many of these either are or have upgraded to bespoke VaR based algorithms. At the same time, there are smaller exchanges that are still using schedule based calculations. Added to this are specific add-ons to cover further risks, for example liquidity, each unique to the CCP involved.

There are even more methodologies to support when cleared OTC products are considered. Many are historical VaR based, but there are examples of algorithms based on parametric VaR. And as with ETD products, there are bespoke add-ons that also need to be supported.

The choice of broker brings its own challenges. An understanding of margin algorithms is required to determine the impact of placing trades with one clearer or another. At the same time it is important to take into account other costs. Some margin add-ons are based on volume, with more being charged for larger positions. At the same time broker costs may also be volume dependent, with lower charges applying for larger volumes.

And it needs to be remembered that the margin calculated by brokers may not be based on CCP methodologies but using their own proprietary algorithm and including all positions held with the broker, not just ETD.

Bilateral trading brings its own complexity; should a trade incur margin, which algorithm should be used to calculate the requirements and has the UMR threshold been exceeded?

Fragmentation brings unique challenges to margin management. The sheer number of algorithms that need to be supported can be overwhelming. And each of these adds to the complexity of supporting the required use cases, such as attribution, optimisation, forecasting and stress testing.