Prisma’s TEA component – what do you need to know?

The impact of the latest add-on for the Prisma methodology on certain portfolios will be quite significant. In some cases, as shown in the example below, increasing total margin by 75%.

What is the change to the Prisma methodology?

Originally, the Prisma methodology did not take into account expiring contracts, the positions which are often acting as a hedge against the rest of the portfolio and thus reducing the market risk component of the margin.

However in these cases, when a position cash-settles and there is an immediate fluctuation in price, the amount calculated may not be sufficient to cover potential losses if this happens during the Margin Period of Risk (the number of days of losses that the margin is intended to cover).

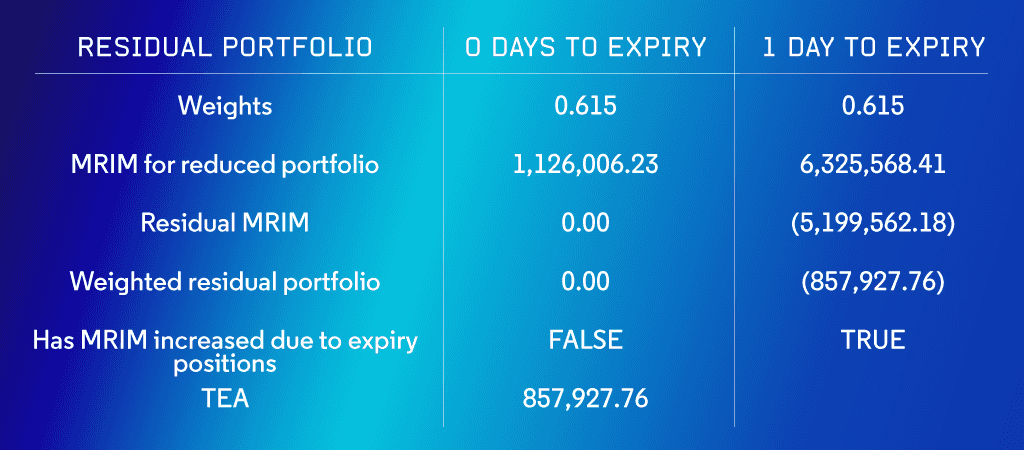

TEA (Time to Expiry Adjustment) looks for positions in cash-settled contracts that are about to expire and have a positive hedging effect on the remainder of the portfolio. It then calculates the difference between the market risk (VaR component) of the margin with and without these positions.

If the position that is expiring causes an increase in this risk, TEA is calculated as a weighted average of this increase over the Margin Period of Risk.

*It’s worth saying here that the same is not true for physically settled contracts. These instead result in a new position in the underlying which will have a market risk similar to that of the expiring derivatives.

What impact may TEA have on margins?

First of all, it will only affect your margin if you have positions in cash settled contracts which are about to expire.

For those of you who do, the impact could be significant. This is best illustrated with an example.

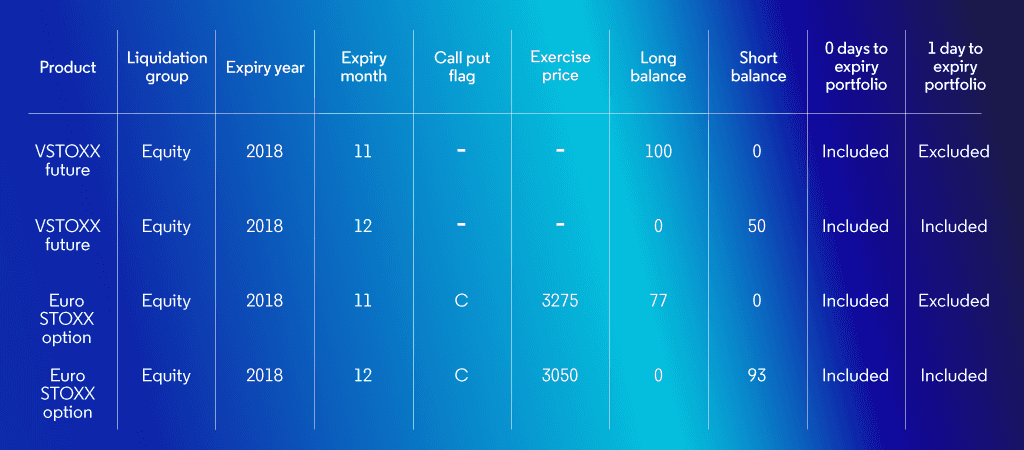

The tables below give a sample calculation for a portfolio of VSTOXX futures and Euro STOXX 50 options. The November Euro STOXX option has 1 day to expiry.