Since its peak following the Russian invasion of Ukraine, volatility in the European power and gas markets has dropped considerably. Prices have fallen and so too have margin requirements. Commodity trading firms are now looking elsewhere for alternative markets that offer them the volatility they seek.

But this is not always as easy as might be expected, with differences in the way that these products work and the way that margin is calculated for them. As an example, we looked at similar contracts traded on ICE, EEX and CME.

The Products

Power products are available for trading on Nymex, ICE and EEX, but the way these contracts are structured varies by market. Some of this is a preference of the exchange, but there are also significant differences in the way that the underlying physical markets are organised that need to be taken into account.

Power contracts are often based on the transmission system:

- ICE UK power contracts as an example are for physical delivery of Electricity through National Grid, with both peak and base load contracts available.

- US Power contracts are more likely to be cash settled against the ISO price, for example Nymex ERN futures are monthly cash settled futures based on the mathematical average of daily prices calculated by averaging the peak hourly electricity prices for ERCOT North 345KV Hub real time.

- EEX German Power futures are financial derivatives contracts on the average power spot market price for the German market area, for both base and peak load.

The size of contracts listed also varies and the way that they behave at expiry. For example, contracts may be listed as day, week, weekend, month, quarter or year. For some markets these immediately convert into a standard contract size before moving to clearing, whereas for others cascading is used to convert contracts into smaller units as they approach expiry.

These product differences can have a significant impact on the way that margin is calculated and the likely level of requirements.

Margin Differences

The most obvious difference in margin will be based on whether a contract is base or peak load, with peak load contracts often being more volatile and therefore resulting in higher requirements. Contracts based on average prices also tend to result in lower margins as they also show less volatility, but this does depend on the way that the averaging works.

Whether contracts remain as the larger groupings, for example as a yearly contract, or are broken down into smaller contracts can also impact the margin requirement. The yearly contract will in general be less volatile and require lower margin payments, but as soon as the contract is broken down the potentially higher margins of the monthly contracts will apply. As an example we have previously conducted analysis on Austrian power contracts that were seeing a 40% increase in margin as the contract cascaded.

Whether or not delivery margin applies and how it is calculated will also vary depending on the specification of a contract. Cash settled contracts should not incur delivery margin, but if there is the potential for the final settlement price to be adjusted or if settlement does not occur until prices for all days within the settlement period have been agreed then some form of security may be required.

And if a contract is deliverable then delivery margin will need to be paid, and the way this is calculated will depend on the risks of the specific delivery process and the risk management decisions taken by the CCP. For some contracts a cash deposit is required to cover delivery risk, whereas for an equivalent contract at a different CCP non-cash collateral may be acceptable.

These differences not only impact the level of margin but they can also affect cash flows.There may for example be delays in final settlement or in releasing initial margin held compared with equivalent contracts.

However, it is the differences in the Initial Margin algorithms used by different CCPs that can impact the requirements and make it harder to decide if it is cost effective to look to trade risk on an alternative market.

Algorithm Differences

At one time, the majority of CCPs clearing energy derivatives would have been using SPAN as their margin algorithm. However, this is all in a state of change, with CME, ICE and EEX all in the process of moving to VaR based margin calculations.

CME has already moved their energy division to SPAN 2, their VaR based methodology. ICE will be following them soon with their move from IRM 1 to IRM 2. Meanwhile ECC, the clearing house for EEX, has announced that they will be moving to the Eurex Prisma VaR based algorithm.

With CCPs moving away from SPAN it is becoming harder to compare the margin based on the venue where the product has been traded. Given the regulations, all CCPs should be looking to cover the same level of risk, but that doesn’t mean that there won’t be differences in the level of requirements. Although all the algorithms use Filtered Historical VaR in some way, both how this is parameterised and how it is applied will vary.

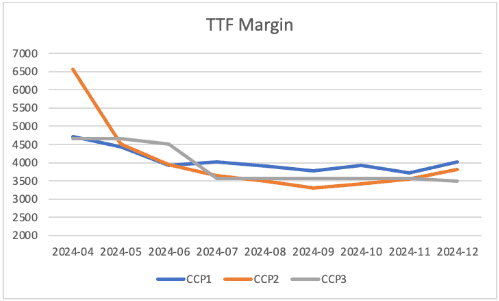

Dutch TTF Natural Gas futures are available for trading on Nymex, ICE and EEX. We analysed the margin for the monthly contract, looking at how this compared based on 1 lot of the monthly contract. We looked at all 2024 expiry dates.

As can be seen, although the margin levels are relatively similar, the cheapest CCP can vary depending on the expiry. This is especially true for the front month, where the difference in margin is significant, with one CCP taking a more cautious approach to the risks of a position approaching delivery.

Conclusion

In order to trade new products to take advantage of the volatility that they offer, firms need to understand the impact this will have on margin. The different structures of the products, such as cash settled versus physically settled, can affect both the level and types of margin that are calculated. Cash flow can also be affected by the different risk frameworks, with some products as an example resulting in cash deposits being held to cover delivery risk.

Choosing products cleared by an alternative CCP will also require support for alternative Initial Margin algorithms. The methodologies used by the major clearers for energy products are all different, and each will exhibit different behaviours that will impact the level of margin requirements.