How the Weather Is Affecting American Power and Gas Margins

Global warming has seen unpredictable weather across the world. In the US, winter has seen some states reporting temperatures significantly below normal levels, while others have seen temperatures well above the seasonal average. This has resulted in highly volatile power and gas prices that usually you would expect to result in increased margin requirements. However, in some cases the margin has actually reduced because of the historically low prices. This unpredictability has highlighted the impact on the margin requirements depending on the products traded, be it choice of exchange, bilateral versus cleared or the use of different contracts. The ability to forecast and optimise margin can have a significant impact on the level of margin paid and hence returns.

Weather

Recent analysis has shown that winter is warming faster than any other season in the US. Since 1970, 70 percent of states have seen increases of at least three degrees.

This winter was no exception. The season was characterised by disparate regional weather patterns. Some states reported significantly below normal temperatures, but a number of others experienced above normal temperatures.

Impact In Gas Supplies and Prices

As a result of the warmer winter temperatures, net withdrawals of natural gas from underground storage facilities were the lowest since the 2015–16 heating season at 1,707 billion cubic feet.

Supply exceeded demand for much of last year which, combined with the lower net withdrawals through winter, left the US with higher stocks than usual.

Natural gas stocks in underground storage facilities totaled 1,830 Bcf on 31st March, according to the Weekly Natural Gas Storage Report (WNGSR), exceeding the five-year average (2018–22) by 294 Bcf (19%), after entering the heating season at a 110 Bcf (3%) deficit to the five-year average.

The result of rising supply and mild weather over winter kept heating demand low and allowed utilities to leave more gas in storage than usual, which caused U.S. natural gas prices to plunge to a 30-month low, going below $2 per million British thermal units (mmBtu), even as some producers cut drilling to relieve further pressure on prices.

Since the start of the year, U.S. gas futures have collapsed by about 50%, a record drop for a quarter.

Impact On Margins

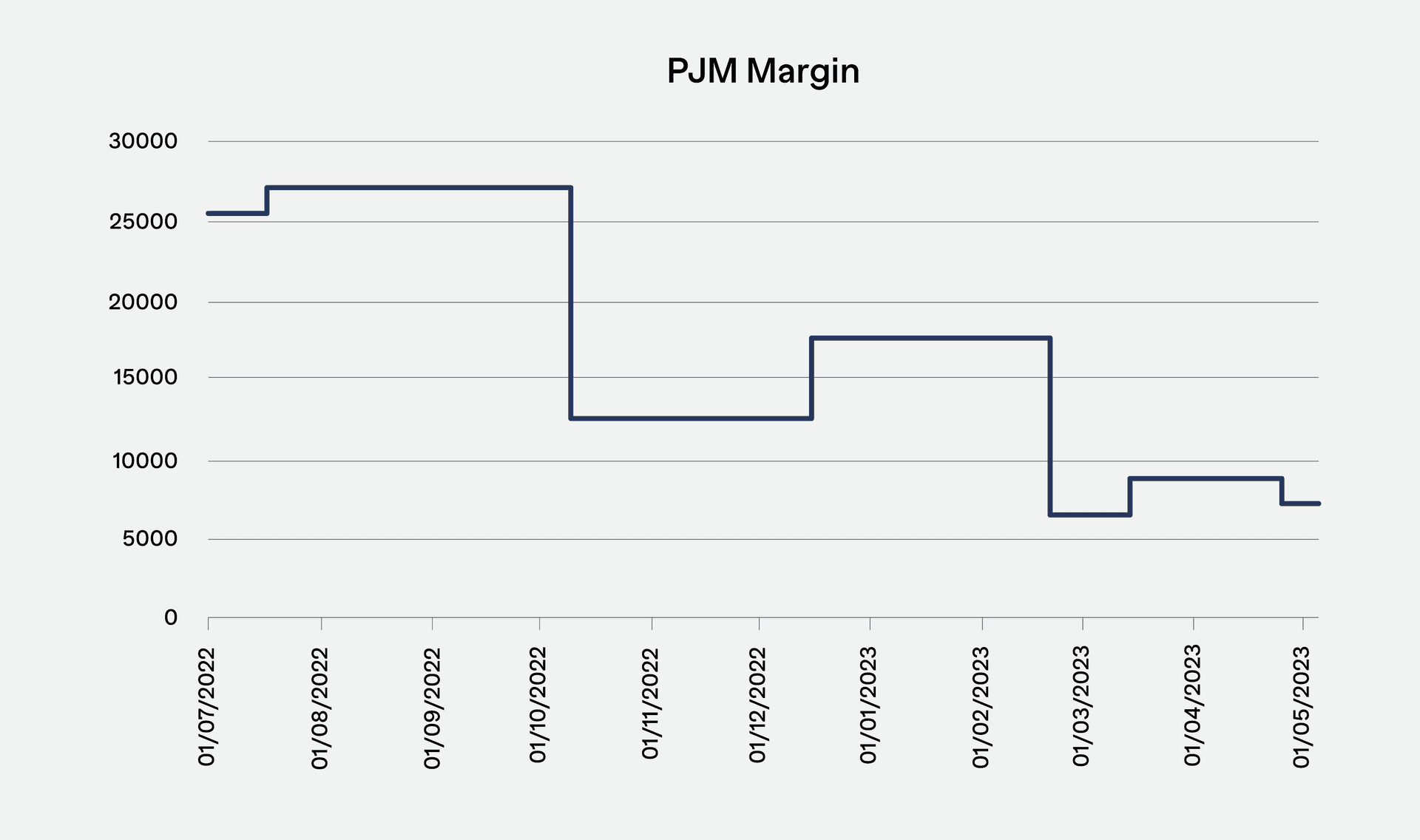

The chart below shows how the margin for front month PJM peak futures has changed since last summer.

It can be seen that from its peak, the margin requirements fell by over 75%. What can also be seen is that although over the period the trend has mostly been downwards, there have been times when significant increases in margin have been seen – for example a 35% increase in the middle of December.

What should also be noted is that some of the largest decreases in margins occurred because the requirements were becoming an unacceptably large percentage of the future price, and not because the analysis performed by the CCPs was automatically showing that they should be reduced. Because of the way that the CCPs determine the margin rate using historical VaR of the underlying price moves, the large changes seen when the prices were high would have suggested that the margin parameters remained at the higher level.

This makes forecasting margins based on potential scenarios even more difficult. What you would normally expect to happen because of the published methodologies isn’t always the case.

What You Can Do

- An overall milder-than-usual winter in a number of states left the US with higher than expected natural gas stocks

- This created downward pressure on prices, with futures collapsing by 50% from the start of the year

- This in turn meant that CCPs were forced to adjust the margin rates on gas futures down by over 75% compared to the start of winter

Power and gas markets are often volatile. But add unpredictable weather events to the mix and the volatility can become extreme. This in turn can lead to sudden changes in margin requirements – you would usually expect increases, but depending on the circumstances margins can also fall.

This margin volatility can make it difficult to get funding correct. A sudden increase in requirements can mean that you don’t have sufficient funding in place to cover margin calls and have to resort to expensive borrowing or closing out of positions in a stressed market.

Have buffers set too high and you can find yourself losing potential income. This is even more important when the weather events are leading to lower prices and drops in margin rates. Adjusting funding can often be the last thing you think about in a volatile market, unless you have the tools in place that help you monitor margin levels and project requirements.

The volatile markets can often highlight the idiosyncrasies of the margin algorithms used within the power and gas markets, as well as the different ways in which the necessary parameters are set. These can result in large differences in margin requirements depending on how and where you trade your risk. This can be something that is difficult to determine unless you have the tools available that allow you to consider the different possibilities, be they choice of product, venue or broker, and optimise the costs of trading – in particular the margin required.

Learn how sudden changes in margin can impact Commodity Trading Firms and how it can be dealt with by taking a look at our Gas and Power Ebook. Additionally, we invite you to explore a wide selection of blogs on our insights page, such as how weather impacts European power and gas margins and how French nuclear power is impacting initial margin.

Lastly, learn more about OpenGamma by watching our demo and taking a look at our product and solutions pages.