When cash was cheap, with interest rates close to zero, firms didn’t worry too much about margin. They could quite cheaply have borrowing facilities in place to meet any unexpected calls on liquidity.

But events have changed this. The hike in prices seen after the Russian Invasion of Ukraine caused many issues with firms finding they didn’t have access to sufficient cash to meet margin calls, much of this caused by a mismatch in payment schedules between OTC and ETD contracts.

At the same time money is no longer cheap. Interest rates have risen steadily and now sit closer to 4% or 5% for many currencies, meaning borrowing is considerably more expensive. Firms need to ensure that they are optimising their liquidity buffers – too large could mean missing investment opportunities but too small risks needing to borrow money or liquidate assets in an emergency – and that could be expensive.

Firms need the flexibility in their liquidity provision to make sure they are able to meet margin calls in times of heightened volatility, whilst at the same time keeping their operating costs as low as possible. In order to determine what these different levels of requirements are likely to be they need to be performing stress testing.

The question then becomes “what stress tests should I be running?”. This isn’t an easy question to answer and will depend on the risk appetite of the firm. Stress tests potentially need to be extreme, but on the other hand they should be plausible. History may be a good indicator of future volatility, but the next big event could be like nothing that has been seen before. This means that some form of theoretical stress tests could also be useful.

And it should also be remembered that sometimes the biggest stress event can be no change. Margins can increase just because hedging positions fall out of a portfolio or because margins tend to rise as contracts move towards expiry.

No Change

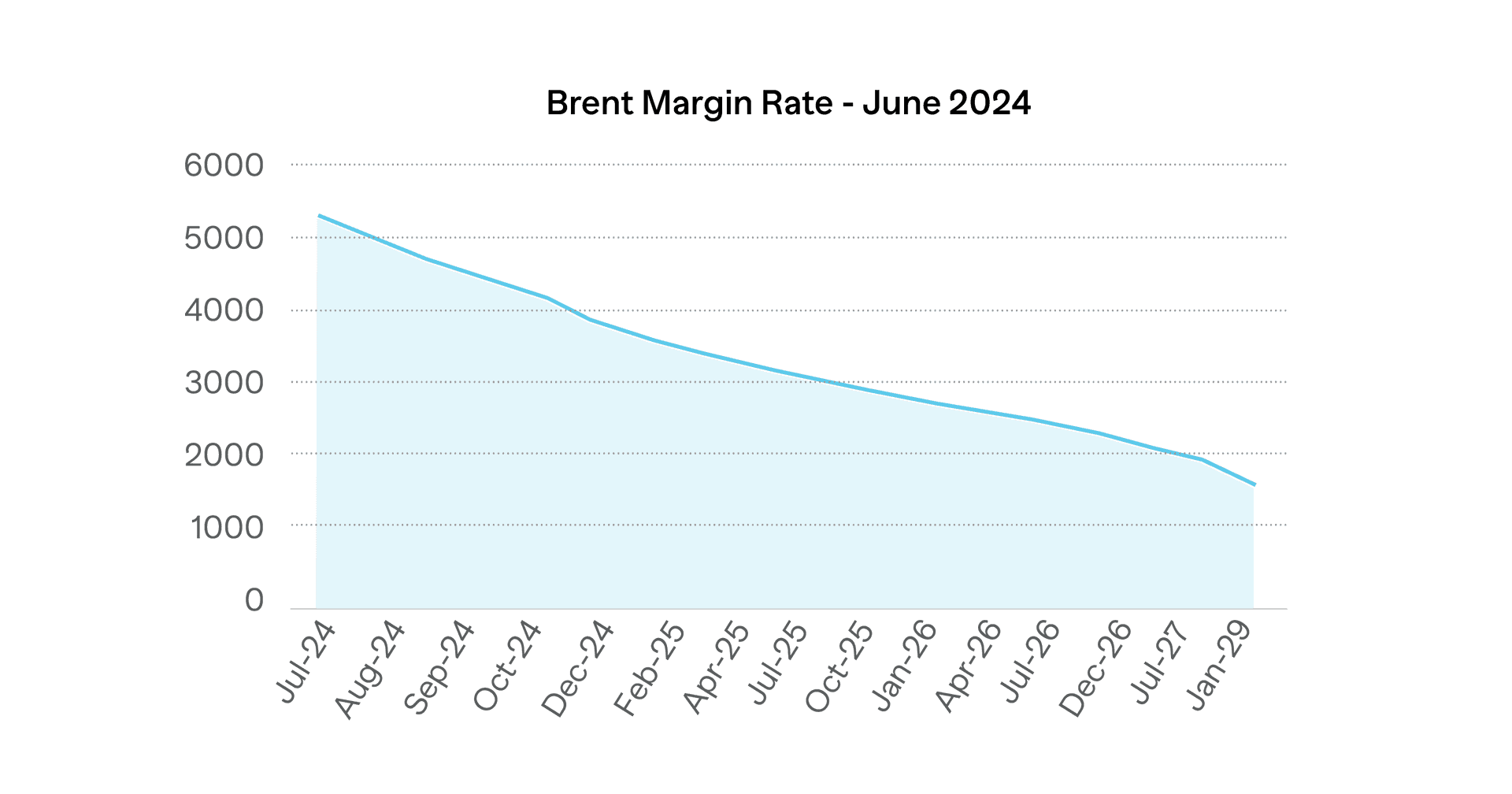

The chart below shows the margin rate for ICE Brent Crude as the expiry moves from August 2023 to February 2028.

For the furthest expiries the Initial Margin is around 33% of the requirement for the front month. As an example of the impact this could have on margin requirements, if you bought a July 2025 contract and held it to expiry a year later, the margin would increase from around $3,200 to $5,300, an increase of 65%.

It can be difficult to predict the impact of ageing on Initial Margin. There are a few general rules that can be applied:

- As contracts move towards expiry the level of Initial Margin tends to increase.

- For a directional portfolio, as contracts expire the level of Initial Margin will reduce.

- But if the portfolio includes hedges, Initial Margin may increase because of the removal of offsets as contracts expire.

But the only accurate way is to systematically age the portfolio and re-calculate the margin based on the alternative expiries.

Stress Testing

The simplest form of stress testing is to apply fixed shocks to prices and recalculate requirements under the implied market conditions. This needs to take into account not just the impact on the price but also on volatility as both of these are used by CCPs in setting the Initial Margin.

For a single defined shock, it is also necessary to model the impact that this will have on other positions. This should include other expiries for the same product as well as other contracts. The easiest way to do this is to assume that current correlations between contracts will continue under the shocked market conditions, although more complex scenarios can be defined, for example ones that assume that correlations break down.

As an example, a range of shocks were defined for PJM Western Hub real time monthly futures. These were then propagated to other PJM expiries and US Power products. Taking into account the way that ICE calculates the margin for these contracts, the potential impact on Initial Margin was calculated:

| Scenario Shift | PJM | CAISO SP15 | ERCOT | MISO |

| 15% | No change | No change | No change | No change |

| 35% | 2% increase | No change | No change | No change |

| 50% | 78% increase | 20% increase | 28% increase | 12% increase |

| 10 times | 26 times | 12 times | 15 times | 11 times |

These varied results show how difficult it is to predict the impact on margin of various price change scenarios. There are a number of factors that need to be considered including current levels of volatility and the way that the CCP margin parameter setting process works. And this becomes even harder when looking at the impact across a portfolio.

An alternative stress testing methodology is to use historical data and recalculate requirements under the market conditions at each point in time. This needs to understand relative expiries so that the correct margin rates can be applied to each of the contracts within the portfolio.

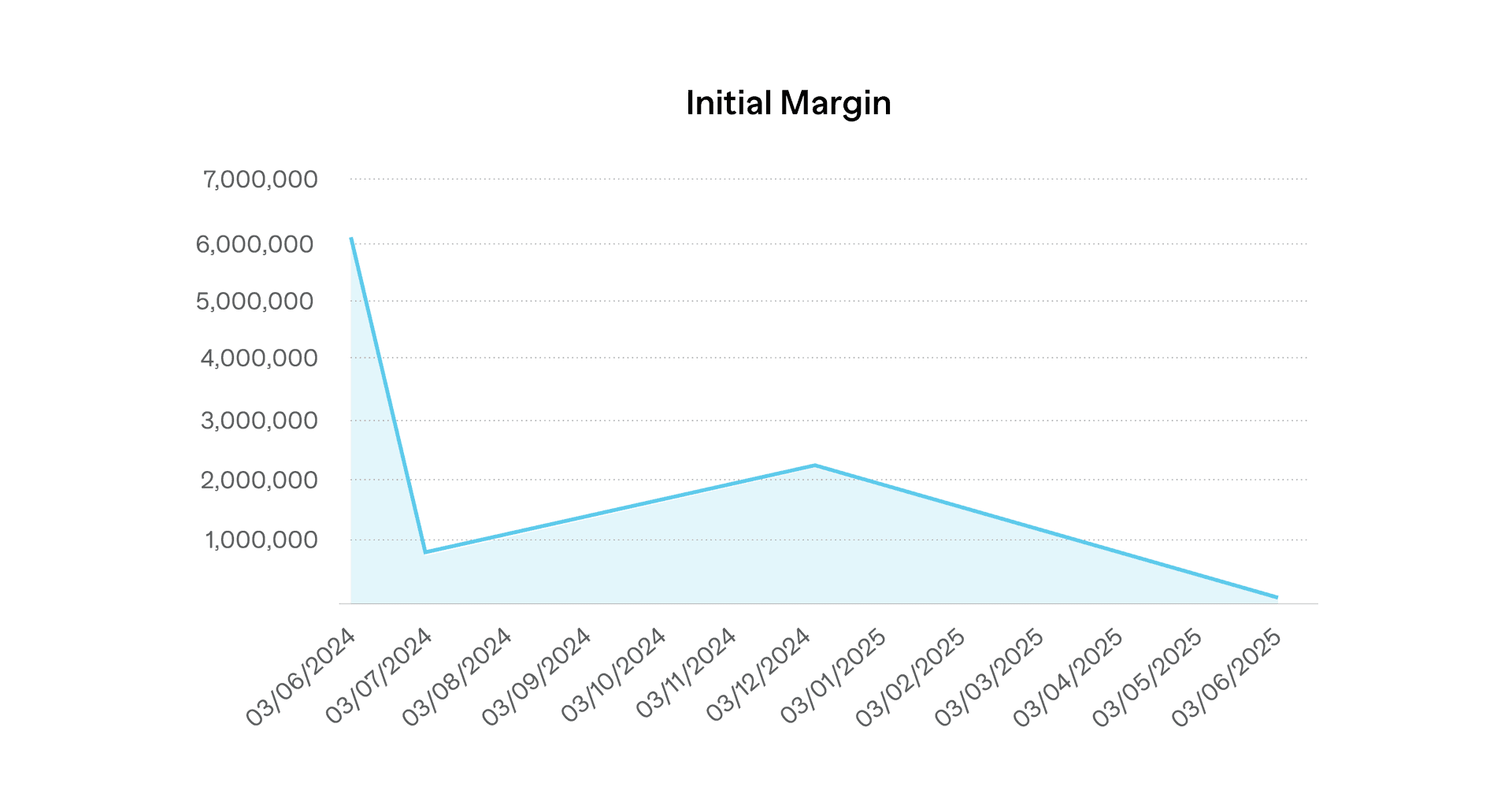

We analysed a hedged portfolio of Liquified Natural Gas and Dutch TTF at ICE. To obtain a benchmark to compare against, we calculated the potential requirements over a one year time horizon taking into account the expiry of contracts within the portfolio.

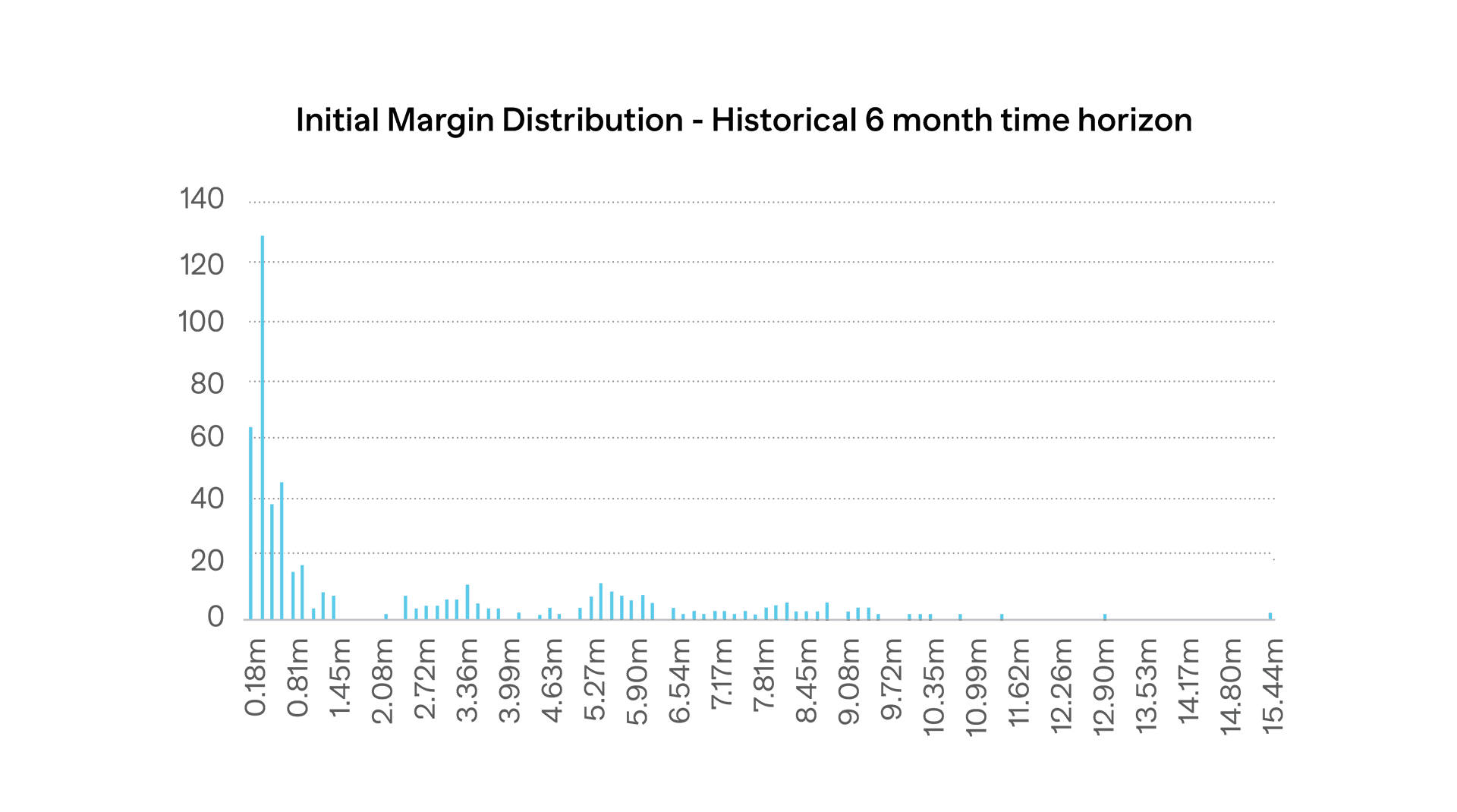

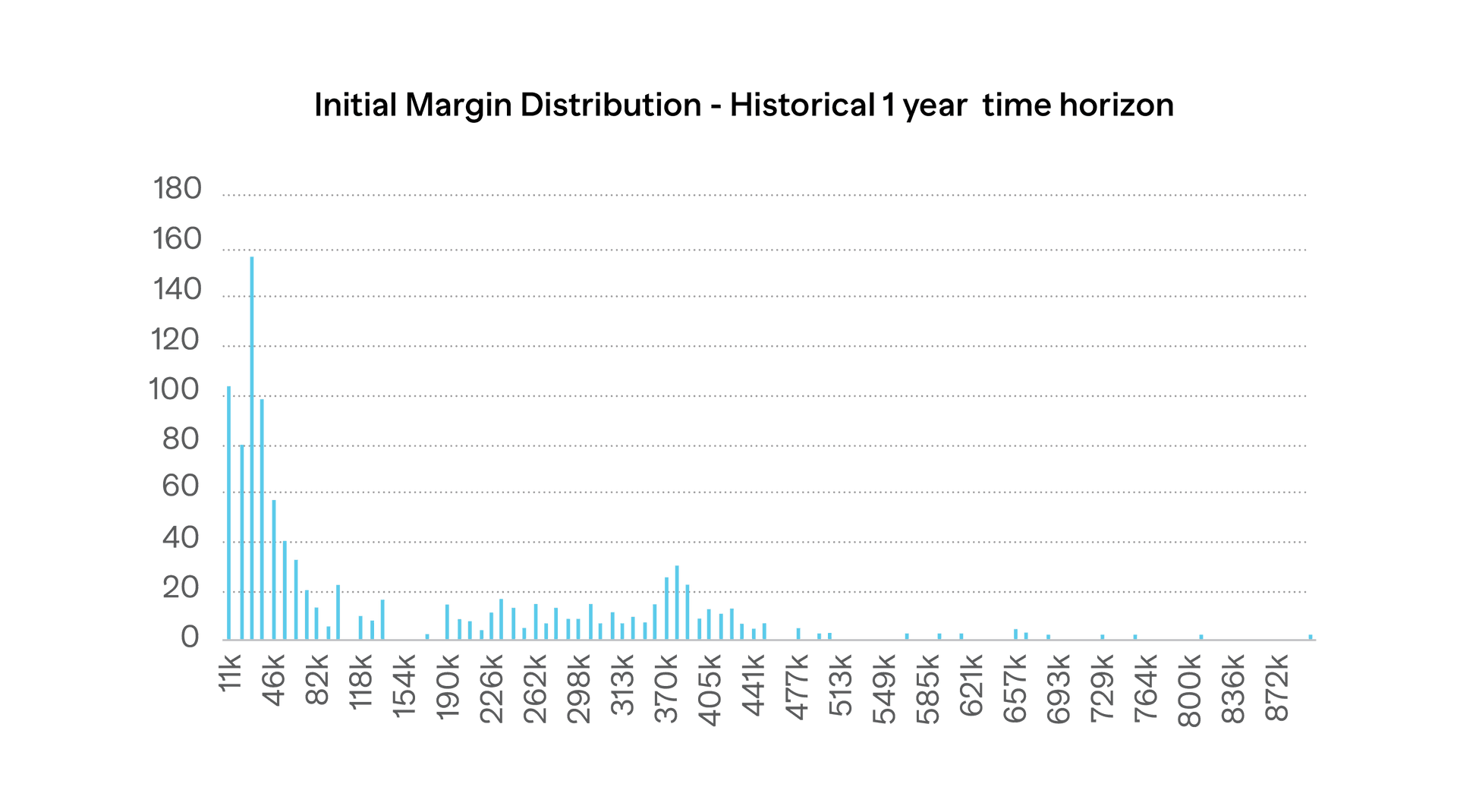

The Initial Margin was then recalculated at the 6 month and one year horizon based on two years of historical data, including some of the recent stress periods caused by the Russian invasion of Ukraine, and a distribution created for each of these.

Scroll to see the next image

As can be seen, the Initial Margin distribution shows a similar pattern for each time horizon, with the majority of the potential requirements being clustered around the expected level based on ageing and current market conditions, but with a significant tail. The loss distribution was also used to determine the Margin at Risk – predicted Initial Margin for a given confidence level.

| Time Horizon | Base Margin | Worst Case Loss | Multiple of Base | Margin at Risk – 95% | Multiple of Base |

| 6 Months | €2.25M | €15.92M | 7.1 times | €8.75M | 3.9 times |

| One Year | €75,000 | €899,000 | 12 times | €500,000 | 6.7 times |

This information can be used by firms to set the size of their liquidity buffers based on their own risk appetite.

How To Implement Flexibility

With the end of cheap money, firms need to ensure that they have flexibility when funding their Initial Margin requirements. Knowing how much they may be called for under different market scenarios, firms can ensure that they have the funding in place when required at an optimum cost.

However, this requires the ability to stress test not just Variation Margin but also Initial Margin. This is only possible with an in depth knowledge of how the various methodologies react under different circumstances. Firms need to consider using a solution that can provide the required stress testing functionality under a range of scenario types.

By conducting stress testing under both theoretical and historical scenarios, firms can minimise the impact of the end of cheap money by making sure that the required liquidity is available when they need it.