Although a futures contract has an expiry date, with an associated physical or cash settlement, only a very small percentage ever reach expiry. Instead, they are rolled over to a different month to avoid the costs and obligations associated with settlement of the contracts– switching from the front month contract that is close to expiration to another contract in a further-out month.

Why Does This Matter?

Everyone has a slightly different reason for deciding when to roll, based on, for example, operational factors or liquidity in the later month. Historically traders didn’t take margin into account when making the decision, however, the large swings in margin cannot be ignored. Therefore, understanding when to roll from a margin level perspective is a key to achieving margin efficiency – rolling too early can have a significant impact on the margin calculated.

Margin On Roll Positions

When a position is rolled, the result is a position with a very similar risk profile except for the shift in the expiry date. You would therefore expect the margin that is calculated on the rolled position to be very similar:

Base margin is being calculated on a position with a very similar DV01 before and after the roll, albeit in different expiries.

Similarly, the process of rolling doesn’t really introduce any significant change of spreads within the portfolio (either calendar spreads or offsets between different products), merely moving them to further out expiries.

Any liquidity charge will be on the new expiry, but based on the same size of position.

But actually it isn’t always the case that the margin stays the same. And if you get it really wrong and roll too early, then the margin calculated can even double.

Why Would Rolling Too Early Double Your Margin?

The liquidity add-on is going to have the biggest impact on your margin if you roll too early.

The factors that impact the level of any liquidity charge are the size of your position and how this compares with the available liquidity. At the roll, liquidity moves from the front month to the next month. Exchanges take this into account when setting their liquidity charges.

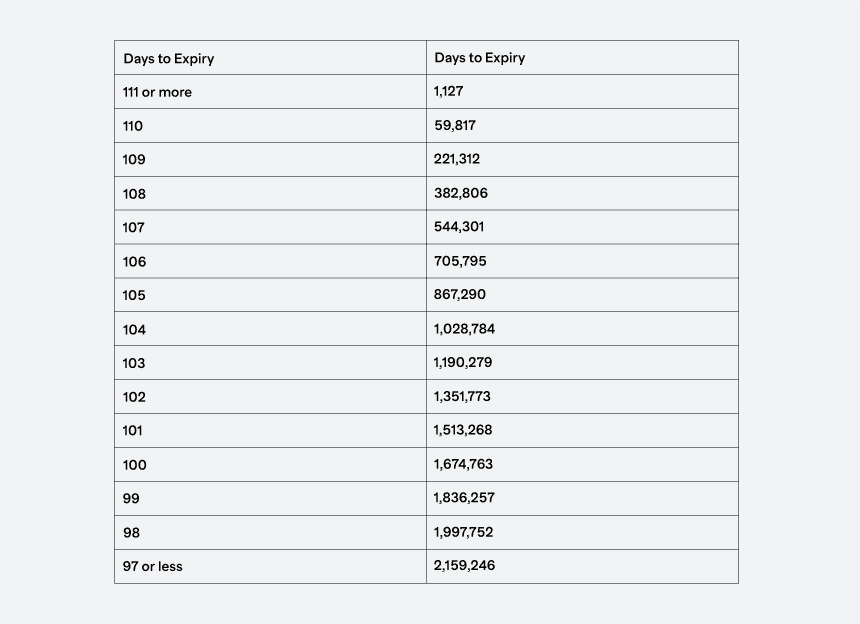

The Eurex Prisma liquidity charge calculation includes a factor based on the ratio of a position with the expected open interest for the contract. During the roll period, this expected open interest for the second month (i.e. the month in which positions are being opened) varies on a daily basis. For example, for the Bund contract the values change as follows:

Therefore, if you roll too early, the exchange will consider that you are moving your position from a liquid expiry (where a low liquidity charge applies) to an illiquid expiry (where a high liquidity charge applies). This liquidity charge will reduce over time, as the old front month reaches expiry, and the second month becomes the new front month. But by then it’s too late, and significant collateral will have been required to fund the additional margin. The liquidity add-on is totally predictable and therefore you can plan the roll in the full knowledge of the margin impact. Don’t roll blind – as you could get a surprise when cash gets sucked out of your fund.

Base Margin Calculation

If the position you are rolling is on an exchange that uses SPAN as the margin algorithm then you may have noticed that – for some products – the scanning range (basically the outright margin that you pay per lot) varies by expiry. Often the scanning range for back months will be higher than the front month level because of the higher volatility seen in the prices. If this is the case then if you roll before the next expiry is considered a front month your margin will increase.

Similarly, spread charges will differ between different expiries. As a result, if you are rolling a portfolio of spread positions you may find that a different, and higher spread charge applies (the spread charges for back months tend to be higher than for nearer dated expiries).

Although not as obvious, because you don’t have explicit parameters, the same rules apply for CCPs that use VaR as a base for their margin algorithm.

When creating the historic scenarios for the VaR calculation, exchanges will have different ways of incorporating the roll. But all will make assumptions about when they believe it is likely to occur – generally within a week or two of the front month expiry. At this point the historic scenarios used for the second month will change from that of a back month to a front month. And this will impact the VaR calculated for any position in that expiry. Most likely the VaR will be higher if the expiry in question is still being considered as a back month.

To Recap:

The choice of date when you roll contracts can have a significant impact on the total margin. In extreme cases, a short term doubling of margin has been seen from rolling too early. Even a smaller percentage increase in margin can impact the bottom line – for example, one fund that rolled too early resulted in a Eur 40 million increase in margin. Although this was only a 4% change in overall margin, it still represented 1% of NAV.

Firms may choose to roll early because the price available is good – but they need to weigh up the cost benefits of rolling early versus the liquidity impact on free cash. This impact is difficult to predict without a detailed understanding of the various margin algorithms, and it is advisable to simulate margin impact pre-roll.

The margin change is created by changes to the CCP liquidity charge; this will be higher if the position is no longer in the liquid front month. In addition, the base margin can be impacted by the use of different VaR scenarios or SPAN parameters based on expiry.