What You Need To Know About SIMM Calculation

Calculating sensitivities for SIMM is one of the toughest challenges created by uncleared margin rules (UMR). OpenGamma’s Head of Product, Veeral Manek, and our Head of Quantitative Research, Marc Henrard, hosted a webinar covering the technicalities of calculating SIMM end-to-end, as firms are preparing for Phase 4 and Phase 5 of UMR.

The webinar will touch base on multiple topics, from providing an overview of SIMM Margin Methodology. How to produce sensitivities and produce a CRIF file to discussing the challenges with SIMM Calculation. Lastly, we will mention what we have learnt from working with firms.

Introduction To Uncleared Margin Rules (UMR)

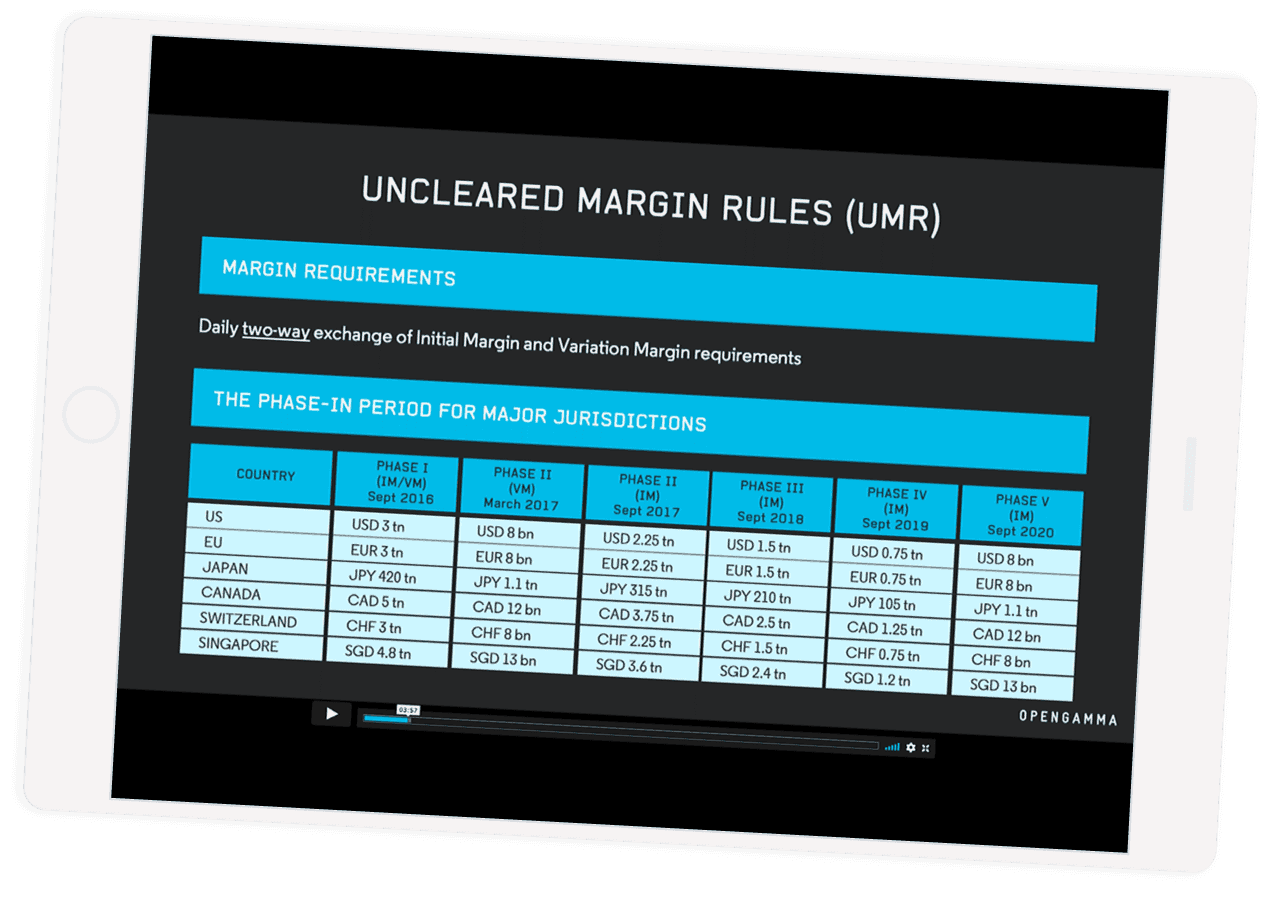

In the first part of our webinar we will provide an introduction and understanding of UMR. Here we will mention why UMR was introduced in the first place and who introduced it. Additionally, we will discuss the difference between UMR and previous margin processes, and also the key requirements of uncleared margin rules.

SIMM Vs GRID

In the following part, we simply take a close look at the differences between SIMM and GRID, specifically the pros and cons of each margin model, in order to help you decide which you should choose. Furthermore, we mention a Hybrid approach, which essentially involves both GRID and SIMM margin models.

SIMM Margin Methodology

We provide an overview of the SIMM methodology, which is a paramedic model which uses sensitivities as an input. Here we take a look at the four product classes that each trade is allocated into and within each product class risk is broken down, so you will also learn the six risk classes. Furthermore, SIMM is calculated for each product class, learn what is taken into account for the calculation.

SIMM Calculation – The Process and The Challenges Involved

Here we will discuss how SIMM is calculated and we will show three screenshots to elaborate the three parts of SIMM calculation. The first screenshot will describe the sensitivies involved, but when sensitivities are calculated they need to be formatted into a CRIF file, which is the second screenshot. Afterwards we detail what will occur once the CRIF file has been generated for each counterparty.

UMR requires a two-way initial margin posting, so calculations need to reconcile with each counterparty on a daily basis. We will go into detail about the causes of initial margin disputes, we have listed the causes below.

. Position Breaks

. Market Data Differences

. Inconsistent Risk Bucket Mappings

. Curve Calibration Techniques

. Model Differences

Curve construction and model differences can lead to differences with sensitivities and initial margin. In our webinar, we will demonstrate this with worked examples. The first example will be “SIMM specific nodes” and the second example will be “the impact of SIMM for a swaption with model differences”. In addition to that, we will briefly discuss other possible sources of discrepancies as well.

What We Have Seen In The Market

We will finish off our webinar by providing insight into the trends that we have seen in the market.

Watch Our Webinar To Learn Everything About SIMM Calculation

This blog is a small glimpse into our webinar. We provide insight and answers to questions in regards to SIMM calculation. Our webinar provides commentary on everything you need to know in regards to SIMM and everything that needs to be taken into account in regards to SIMM calculation.